The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Heron Therapeutics Inc (NASDAQ:HRTX).

Heron Therapeutics Inc (NASDAQ:HRTX) has seen an increase in activity from the world’s largest hedge funds in recent months. There were 12 funds in our database bullish on the stock at the end of September. At the end of this article we will also compare HRTX to other stocks including Rent-A-Center Inc (NASDAQ:RCII), Capella Education Company (NASDAQ:CPLA), and LHC Group, Inc. (NASDAQ:LHCG) to get a better sense of its popularity.

Follow Heron Therapeutics Inc. (NASDAQ:HRTX)

Follow Heron Therapeutics Inc. (NASDAQ:HRTX)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

g0d4ather/Shutterstock.com

With all of this in mind, let’s review the recent action encompassing Heron Therapeutics Inc (NASDAQ:HRTX).

What have hedge funds been doing with Heron Therapeutics Inc (NASDAQ:HRTX)?

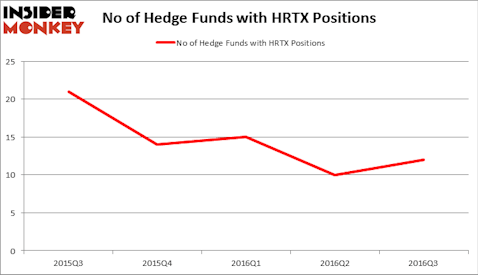

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, versus 10 funds at the end of June. Below, you can check out the change in hedge fund sentiment towards HRTX over the last five quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Tang Capital Management, led by Kevin C. Tang, holds the largest position in Heron Therapeutics Inc (NASDAQ:HRTX). Tang Capital Management has a $106.8 million position in the stock, comprising 44.3% of its 13F portfolio. The second most bullish fund is Christopher James’ Partner Fund Management, with a $58.4 million position; the fund has 1.7% of its 13F portfolio invested in the stock. Other members of the smart money that are bullish consist of Julian Baker and Felix Baker’s Baker Bros. Advisors, Kevin Kotler’s Broadfin Capital, and Mark Kingdon’s Kingdon Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.