At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Hartford Financial Services Group Inc (NYSE:HIG) investors should be aware of an increase in hedge fund sentiment of late. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as International Paper Company (NYSE:IP), Realty Income Corp (NYSE:O), and Analog Devices, Inc. (NASDAQ:ADI) to gather more data points.

Follow Hartford Insurance Group Inc. (NYSE:HIG)

Follow Hartford Insurance Group Inc. (NYSE:HIG)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

nito/Shutterstock.com

Keeping this in mind, we’re going to view the latest action surrounding Hartford Financial Services Group Inc (NYSE:HIG).

What have hedge funds been doing with Hartford Financial Services Group Inc (NYSE:HIG)?

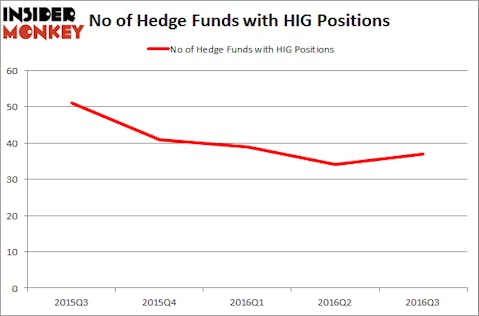

At Q3’s end, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, an increase of 9% from one quarter earlier. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, East Side Capital (RR Partners), managed by Steven Richman, holds the most valuable position in Hartford Financial Services Group Inc (NYSE:HIG). East Side Capital (RR Partners) has a $257.1 million position in the stock, comprising 12.4% of its 13F portfolio. The second most bullish fund manager is Diamond Hill Capital, led by Ric Dillon, holding a $160.4 million position; 1% of its 13F portfolio is allocated to the stock. Remaining professional money managers with similar optimism comprise Israel Englander’s Millennium Management, Dmitry Balyasny’s Balyasny Asset Management and Matthew Mark’s Jet Capital Investors.

As one would reasonably expect, key money managers were breaking ground themselves. Diamond Hill Capital, managed by Ric Dillon, created the most outsized position in Hartford Financial Services Group Inc (NYSE:HIG). Diamond Hill Capital had $160.4 million invested in the company at the end of the quarter. Matthew Mark’s Jet Capital Investors also made a $57.8 million investment in the stock during the quarter. The other funds with brand new HIG positions are Glenn Russell Dubin’s Highbridge Capital Management, Ken Griffin’s Citadel Investment Group, and Joe DiMenna’s ZWEIG DIMENNA PARTNERS.

Let’s now review hedge fund activity in other stocks similar to Hartford Financial Services Group Inc (NYSE:HIG). We will take a look at International Paper Company (NYSE:IP), Realty Income Corp (NYSE:O), Analog Devices, Inc. (NASDAQ:ADI), and Magellan Midstream Partners, L.P. (NYSE:MMP). All of these stocks’ market caps are similar to HIG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IP | 33 | 457001 | 13 |

| O | 20 | 170614 | 6 |

| ADI | 27 | 1281274 | 1 |

| MMP | 14 | 123130 | -2 |

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $508 million. That figure was $1.04 billion in HIG’s case. International Paper Company (NYSE:IP) is the most popular stock in this table. On the other hand Magellan Midstream Partners, L.P. (NYSE:MMP) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Hartford Financial Services Group Inc (NYSE:HIG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.