The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Forward Pharma A/S (NASDAQ:FWP).

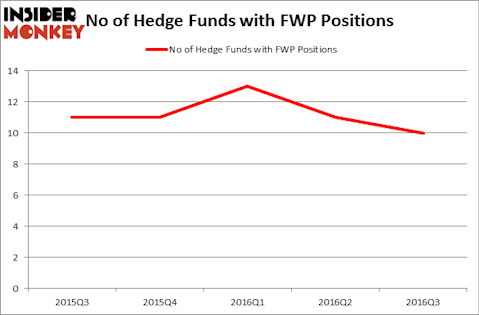

Is Forward Pharma A/S (NASDAQ:FWP) a bargain? Investors who are in the know scoff at that idea, as they’re in a bearish mood. The number of bullish hedge fund positions inched down by 1 recently. FWP was in 10 hedge funds’ portfolios at the end of the third quarter of 2016. There were 11 hedge funds in our database with FWP holdings at the end of the second quarter. At the end of this article we will also compare FWP to other stocks including US Ecology Inc. (NASDAQ:ECOL), Healthways, Inc. (NASDAQ:HWAY), and Rush Enterprises, Inc. (NASDAQ:RUSHA) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

How are hedge funds trading Forward Pharma A/S (NASDAQ:FWP)?

Heading into the fourth quarter of 2016, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a 9% decline from the previous quarter. On the other hand, there were a total of 11 hedge funds with a bullish position in FWP at the beginning of this year, so the yearly decline is slightly lower. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Seth Klarman’s Baupost Group holds the largest position in Forward Pharma A/S (NASDAQ:FWP). Baupost Group has a $112.7 million position in the stock, comprising 1.6% of its 13F portfolio. Sitting at the No. 2 spot is Mark Lampert of Biotechnology Value Fund / BVF Inc holding a $29.1 million position; 5.5% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors with similar optimism include Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, Samuel Isaly’s OrbiMed Advisors, and Joseph Edelman’s Perceptive Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

We view hedge fund activity in the stock as unfavorable, but in this case there was only a single hedge fund selling its entire position: EcoR1 Capital. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 700+ hedge funds tracked by Insider Monkey identified FWP as a viable investment and initiated a position in the stock.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Forward Pharma A/S (NASDAQ:FWP) but similarly valued. These stocks are US Ecology Inc. (NASDAQ:ECOL), Healthways, Inc. (NASDAQ:HWAY), Rush Enterprises, Inc. (NASDAQ:RUSHA), and Windstream Corporation (NASDAQ:WIN). All of these stocks’ market caps are similar to FWP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ECOL | 8 | 66931 | -3 |

| HWAY | 19 | 279048 | 1 |

| RUSHA | 11 | 77124 | 1 |

| WIN | 13 | 90590 | 3 |

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $128 million. That figure was $208 million in FWP’s case. Healthways, Inc. (NASDAQ:HWAY) is the most popular stock in this table. On the other hand US Ecology Inc. (NASDAQ:ECOL) is the least popular one with only 8 bullish hedge fund positions. Forward Pharma A/S (NASDAQ:FWP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HWAY might be a better candidate to consider taking a long position in.

Disclosure: None