A SWOT analysis is a look at a company’s strengths, weaknesses, opportunities, and threats, and is a tremendous way to gain a detailed and thorough perspective on a company and its future. As 2013 begins, I would like to pinpoint on a leading global producer of cars and trucks, Ford Motor Company (NYSE:F).

The Business:

Warren Buffett once said, “Never invest in a business you can’t understand.” This not only allows the investor to purchase a company with conviction, however also allows them to spot trends blind to unfamiliar eyes. With this in mind, investors in any company should fully understand the business model of the company. Ford is a global producer of cars and trucks operating in two main segments; automotive and financial services. Ford operates throughout North America, South America, Europe, Asia Pacific, and Africa. Based on market capitalization, the company is valued at $49.64 billion. Because of the incredibly competitive nature of the automotive industry, Ford Motor (NYSE:F) possesses a profit margin of 4.38%.

1). Steady Revenue Growth: In 1990, Ford reported revenue slightly under $100 billion; in 2011, the company announced revenue of $128.20 billion, representing year over year annual growth of 1.19% (this growth has been a result of consistent product innovation driving sales growth)

2). Basement Valuation: At the moment, Ford carries a price to earnings ratio of 2.94, a price to book ratio of 3.31, and a price to sales ratio of 0.36; all of which indicate a company trading with a basement valuation

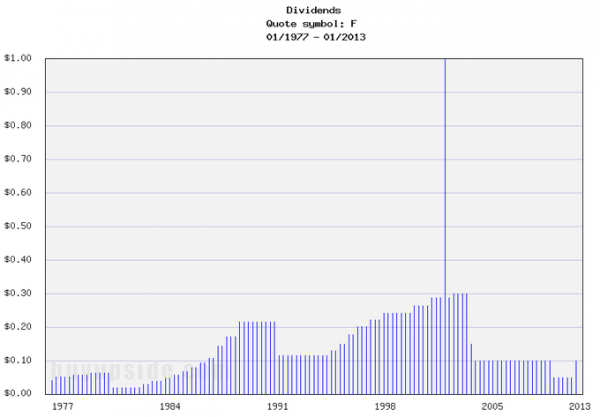

3). Dividend: Presently, Ford pays out quarterly dividends of $0.10, which annualized puts the dividend as yielding 3.07%, a major upside for long-term investors

4). Positive Free Cash Flow: In 2013, Ford is projected to create $4.56 billion in free cash flow, allowing the company to reward shareholders and reinvest in their own business

5). Institutional Vote of Confidence: 56% of shares outstanding are held by institutional investors, displaying the confidence some of the largest investors in the world have in the company and its future

5). Brand Loyalty: Ford’s brand value is estimated to be $17.56 billion, and with the Ford brand name comes a certain level of brand loyalty many customers display, a major strength to the business

Weaknesses:

1). Volatility: Currently, the company withholds a beta ratio of 2.28, representing a company trading with considerably more volatility than the overall market, a major weakness for long-term investors

2). Net Debt: Despite possessing $24 billion in cash and cash equivalents on their balance sheets, Ford’s $36 billion debt load results in a net debt of $12 billion, a rather substantial number

Opportunities:

1). Dividend Growth: Since implementing their dividend program in 1983, Ford has consistently raised their dividend payouts, a trend which is highly anticipated to sustain into the future

2). Gaining Market Share: Market share is a paramount statistic for Ford (North America Truck Market 2008: 17.6% Currently: 19.9% North America Car Market 2008: 7.88% Currently: 10.7% International Cars & Truck Market 2008: 5.43% Currently: 4.42%) and any gain in market share the company is able to make will fuel sales growth

3). Growth in International & US Automotive Markets: The United States and international automotive markets have been expanding over the past years and are projected to continue to do so into the future, and any growth in the global automotive markets could present incredible opportunity to the company

4). Product Innovation: Ford possesses a long history of product innovations, and any further innovations that results in new products could spark customer interest and fuel sales growth

5). Acquisitions: In January 2011, Ford completed its acquisition of Cologne Precision Forge GmbH, and any further acquisitions in the future could introduce new technologies to the company and fuel growth