Is Erie Indemnity Company (NASDAQ:ERIE) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other successful investors have numerous Ivy league graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments (for some reason media paid a ton of attention to Ackman’s gigantic JC Penney and Valeant failures) and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

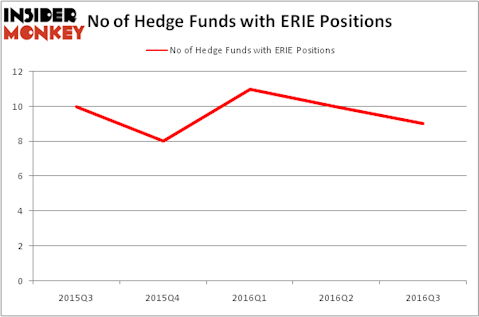

Is Erie Indemnity Company (NASDAQ:ERIE) undervalued? The smart money is actually in a bearish mood. The number of long hedge fund investments contracted by 1 recently. In this way, there were 9 hedge funds in our database with ERIE holdings at the end of the third quarter. At the end of this article we will also compare ERIE to other stocks including Berry Plastics Group Inc (NYSE:BERY), Grupo Aeroportuario del Pacifico (ADR) (NYSE:PAC), and iShares MSCI ACWI Index Fund (NASDAQ:ACWI) to get a better sense of its popularity.

Follow Erie Indemnity Co (NASDAQ:ERIE)

Follow Erie Indemnity Co (NASDAQ:ERIE)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

What does the smart money think about Erie Indemnity Company (NASDAQ:ERIE)?

At Q3’s end, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, down by 10% from the second quarter of 2016. By comparison, 8 hedge funds held shares or bullish call options in ERIE heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Royce & Associates, led by Chuck Royce, holds the biggest position in Erie Indemnity Company (NASDAQ:ERIE). Royce & Associates has a $42.2 million position in the stock. Coming in second is Renaissance Technologies, one of the largest hedge funds in the world with a $9 million position. Remaining professional money managers with similar optimism comprise D. E. Shaw’s D E Shaw, Cliff Asness’ AQR Capital Management and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.