At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Entravision Communication (NYSE:EVC) investors should be aware of a decrease in support from the world’s most elite money managers of late, as hedge fund ownership slipped by 1. At the end of this article we will also compare EVC to other stocks including 1-800-FLOWERS.COM, Inc. (NASDAQ:FLWS), Qiwi PLC (NASDAQ:QIWI), and Rayonier Advanced Materials Inc (NYSE:RYAM) to get a better sense of its popularity.

Follow Entravision Communications Corp (NYSE:EVC)

Follow Entravision Communications Corp (NYSE:EVC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

alexwhite/Shutterstock.com

How are hedge funds trading Entravision Communication (NYSE:EVC)?

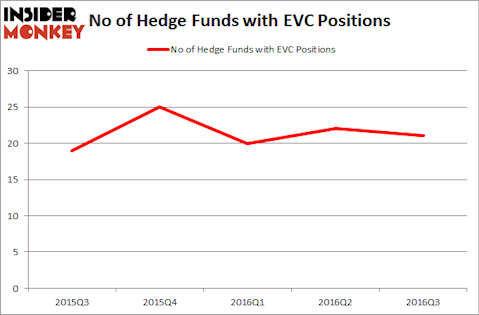

Heading into the fourth quarter of 2016, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 5% dip from one quarter earlier. After a volatile couple of quarters in terms of hedge fund ownership, the stock appears to have settled into a groove. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, West Face Capital, managed by Greg Boland, holds the most valuable position in Entravision Communication (NYSE:EVC). West Face Capital has a $46 million position in the stock, comprising 26.3% of its 13F portfolio. Coming in second is William C. Martin of Raging Capital Management, with a $14 million position; the fund has 1.9% of its 13F portfolio invested in the stock. Other professional money managers that are bullish include Jim Simons’ Renaissance Technologies, Jeffrey Bronchick’s Cove Street Capital and Chuck Royce’s Royce & Associates.