The SEC requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings discloses the funds’ positions on September 30. We at Insider Monkey have compiled an extensive database of more than 700 of those successful funds and prominent investors’ filings. In this article, we analyze how these successful funds and prominent investors traded Discovery Communications Inc. (NASDAQ:DISCA) based on those filings.

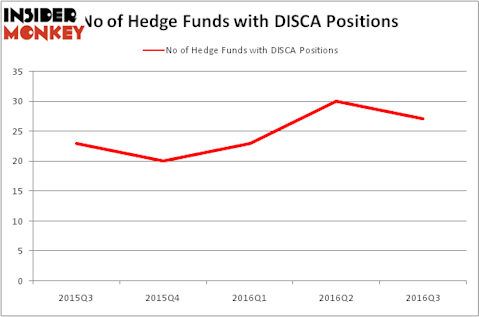

Is Discovery Communications Inc. (NASDAQ:DISCA) a first-rate investment today? Prominent investors are actually taking a bearish view. The number of long hedge fund positions that are disclosed in regulatory 13F filings slashed by3 recently. DISCA was in 27 hedge funds’ portfolios at the end of September. There were 30 hedge funds in our database with DISCA positions at the end of the previous quarter. At the end of this article we will also compare DISCA to other stocks including Dell Technologies Inc (NYSE:DVMT), Annaly Capital Management, Inc. (NYSE:NLY), and Restaurant Brands International Inc (NYSE:QSR) to get a better sense of its popularity.

Follow Warner Bros. Discovery Inc. (NASDAQ:WBD)

Follow Warner Bros. Discovery Inc. (NASDAQ:WBD)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

alexwhite/Shutterstock.com

How are hedge funds trading Discovery Communications Inc. (NASDAQ:DISCA)?

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, down by 10% from one quarter earlier. By comparison, 20 hedge funds held shares or bullish call options in DISCA heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ken Griffin’s Citadel Investment Group has the number one position in Discovery Communications Inc. (NASDAQ:DISCA), worth close to $84.3 million. The second largest stake is held by Mario Gabelli of GAMCO Investors, with a $61.3 million position. Some other hedge funds and institutional investors that hold long positions include John Brennan’s Sirios Capital Management, Joel Greenblatt’s Gotham Asset Management and Murray Stahl’s Horizon Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually said goodbye to their positions entirely. At the top of the heap, Wallace Weitz’s Wallace R. Weitz & Co. said goodbye to the biggest investment of all the investors tracked by Insider Monkey, worth close to $38.2 million in stock. Steve Cohen’s fund, Point72 Asset Management, also sold off its stock, about $10.2 million worth.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Discovery Communications Inc. (NASDAQ:DISCA) but similarly valued. These stocks are Dell Technologies Inc (NYSE:DVMT), Annaly Capital Management, Inc. (NYSE:NLY), Restaurant Brands International Inc (NYSE:QSR), and Discovery Communications Inc. (NASDAQ:DISCK). This group of stocks’ market caps are closest to DISCA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DVMT | 86 | 3586212 | 86 |

| NLY | 13 | 120034 | -4 |

| QSR | 32 | 3143758 | 1 |

| DISCK | 21 | 280090 | -3 |

As you can see these stocks had an average of 38 hedge funds with bullish positions and the average amount invested in these stocks was $1.78 billion. That figure was $293 million in DISCA’s case. Dell Technologies Inc (NYSE:DVMT) is the most popular stock in this table. On the other hand Annaly Capital Management, Inc. (NYSE:NLY) is the least popular one with only 13 bullish hedge fund positions. Discovery Communications Inc. (NASDAQ:DISCA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard DVMT might be a better candidate to consider taking a long position in.

Disclosure: None