The market has been volatile due to elections and the potential of another Federal Reserve rate increase. Small cap stocks have been on a tear, as the Russell 2000 ETF (IWM) has outperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of June. SEC filings and hedge fund investor letters indicate that the smart money seems to be getting back in stocks, and the funds’ movements is one of the reasons why small-cap stocks are red hot. In this article, we analyze what the smart money thinks of Crescent Point Energy Corp (NYSE:CPG) and find out how it is affected by hedge funds’ moves.

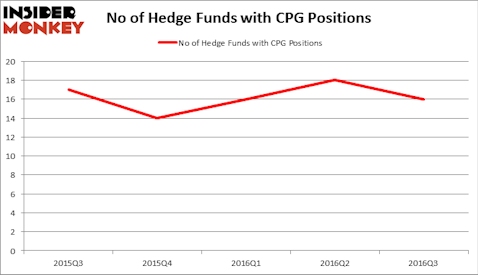

Is Crescent Point Energy Corp (NYSE:CPG) a bargain? The smart money is really taking a bearish view. The number of bullish hedge fund bets that are revealed through the 13F filings went down by 2 in recent months. There were 18 hedge funds in our database with CPG holdings at the end of June. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as ITC Holdings Corp. (NYSE:ITC), Qorvo Inc (NASDAQ:QRVO), and Alkermes Plc (NASDAQ:ALKS) to gather more data points.

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Corepics VOF/Shutterstock.com

Now, let’s view the new action regarding Crescent Point Energy Corp (NYSE:CPG).

How are hedge funds trading Crescent Point Energy Corp (NYSE:CPG)?

At Q3’s end, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -11% from the previous quarter. On the other hand, there were a total of 14 hedge funds with a bullish position in CPG at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holds the number one position in Crescent Point Energy Corp (NYSE:CPG). Arrowstreet Capital has a $17.8 million position in the stock, comprising 0.1% of its 13F portfolio. The second most bullish fund manager is Citadel Investment Group, led by Ken Griffin, which holds a $9.5 million position; the fund has less than 0.1% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish consist of Israel Englander’s Millennium Management, Cliff Asness’ AQR Capital Management and Philippe Jabre’s Jabre Capital Partners. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.