So what should we expect in the near future?

One of the main factors that put the company in its dire situation was the low prices of natural gas that reached the $2/mmbtu mark during the first half of 2012. This low rate isn’t likely to repeat itself in 2013. Therefore, the company is likely to recover and show higher profit margins than it did back in 2012 (at least from the standpoint of price effect). At the same time, the price of natural gas is likely to remain low compared to its five year average. Chesapeake sold many of its assets and in the process may have shifted from natural gas projects to oil projects. If the company will keep raising its exposure to oil and at the same time lowering its exposure to natural gas, then this could also lead to higher profit margins (assuming of course the price of oil won’t tumble down during the year).

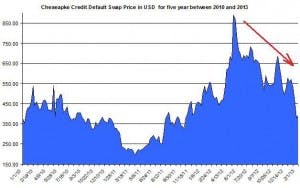

The change that the company implemented hasn’t gone unnoticed as some of the confidence in the Chesapeake returned, as its CDS came down from its record high prices.

The company’s credit default swap (five years, in US dollars) has decreased in the past several months: it has decreased from nearly 869 basis points back in May 2012 to nearly 392 bp as of the beginning of February – this represents nearly 476 basis points drop. The current price of 392 bp means the annual premium is $392 thousand in case of a default of $10 million of debt within the next five years for this company. The tumble in the CDS is another indication for Chesapeake’s slow recovery as the company is slowly regaining the confidence of both bondholders and shareholders.

Based of the above, I think the recent developments in Chesapeake might further lower its risk. But Chesapeake will still have a lot to do in order to regain the confidence of its investors.

The author holds no positions in stocks mentioned and does not plan to initiate positions within 120 hours of the posting of this article. This article is to be used for educational, research and informational purposes only and does not constitute investment advice. There are no guarantees, expressed or implied, of future positive returns in regards to the subject matter contained herein. Understand the risks inherent in investing before making the decision to invest or consult an investment professional for more information. Reasonable due diligence has been performed in regards to the information in this article. However, the author expressly disclaims any liability for accidental omissions of information or errors in fact.

The article Is Chesapeake Regaining Our Confidence? originally appeared on Fool.com and is written by Lior Cohen.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.