It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. The Standard and Poor’s 500 Index returned 7.6% over the 12-month period ending November 21, while more than 51% of the constituents of the index underperformed the benchmark. Hence, a random stock picking process will most likely lead to disappointment. At the same time, the 30 most favored mid-cap stocks by the best performing hedge funds monitored by Insider Monkey generated a return of 18% over the same time span. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Caesarstone Ltd (NASDAQ:CSTE).

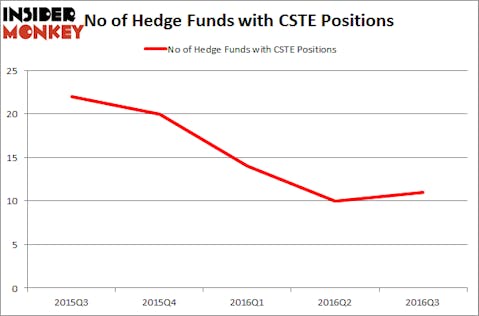

Is Caesarstone Ltd (NASDAQ:CSTE) a buy, sell, or hold? The best stock pickers are altogether buying. The number of bullish hedge fund bets that are revealed through 13F filings advanced by 1 recently. CSTE was in 11 hedge funds’ portfolios at the end of September. There were 10 hedge funds in our database with CSTE holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as CNOOC Limited (ADR) (NYSE:CEO), First Cash Financial Services, Inc. (NASDAQ:FCFS), and Lakeland Financial Corporation (NASDAQ:LKFN) to gather more data points.

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

lassedesignen/Shutterstock.com

What have hedge funds been doing with Caesarstone Ltd (NASDAQ:CSTE)?

Heading into the fourth quarter of 2016, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 10% increase from one quarter earlier. However, that followed three quarters of sharp declines in hedge fund ownership of the stock. The graph below displays the number of hedge funds with bullish position in CSTE over the last 5 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Joho Capital, led by Robert Karr, holds the number one position in Caesarstone Ltd (NASDAQ:CSTE). Joho Capital has a $51.8 million position in the stock, comprising 10.2% of its 13F portfolio. The second largest stake is held by Anchor Bolt Capital, led by Robert Polak, which holds a $36.3 million position; 1.1% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions include Steve Cohen’s Point72 Asset Management, Robert Hockett’s Covalent Capital Partners, and Ken Griffin’s Citadel Investment Group. We should note that Joho Capital is among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.