The Russell 2000 ETF (IWM) has shot up by 38% since hitting a 52-week low on February 11, easily outdistancing the S&P 500 ETF (SPY)’s 19% gains during that time. Nor is the small-cap rally likely to be over. History shows that after periods of 15% or greater declines in the Russell 2000 ETF, it has responded with average gains of nearly 100%. In fact, only once did the rebound run come in below 60% gains. It’s no wonder then that hedge funds appear to be aggressively putting their money back into small-cap stocks. In this article, we’ll look at their Q3 trading habits in regards to Biogen Idec Inc. (NASDAQ:BIIB).

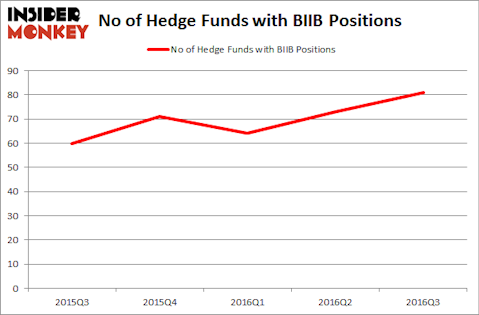

Is Biogen Idec Inc. (NASDAQ:BIIB) a buy here? Investors who are in the know are unmistakably turning bullish. The number of long hedge fund investments strengthened by 8 lately. In this way, there were 81 hedge funds in our database with BIIB positions at the end of the third quarter. At the end of this article we will also compare BIIB to other stocks including Mitsubishi UFJ Financial Group Inc (ADR) (NYSE:MTU), Avago Technologies Ltd (NASDAQ:AVGO), and Mondelez International Inc (NASDAQ:MDLZ) to get a better sense of its popularity.

Follow Biogen Inc. (NASDAQ:BIIB)

Follow Biogen Inc. (NASDAQ:BIIB)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

How are hedge funds trading Biogen Idec Inc. (NASDAQ:BIIB)?

At Q3’s end, a total of 81 of the hedge funds tracked by Insider Monkey were bullish on this stock, up by 11% from the second quarter of 2016. On the other hand, there were a total of 71 hedge funds with a bullish position in BIIB at the beginning of this year. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Viking Global, led by Andreas Halvorsen, holds the biggest position in Biogen Idec Inc. (NASDAQ:BIIB). Viking Global has a $684.4 million position in the stock, comprising 3% of its 13F portfolio. On Viking Global’s heels is D E Shaw, one of the largest hedge funds in the world, with a $504.4 million position. Other members of the smart money that are bullish include Samuel Isaly’s OrbiMed Advisors, and Cliff Asness’ AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As aggregate interest increased, specific money managers were breaking ground themselves. Highline Capital Management, led by Jacob Doft, initiated the most valuable call position in Biogen Idec Inc. (NASDAQ:BIIB). Highline Capital Management had $76.3 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $71.7 million investment in the stock during the quarter. The other funds with new positions in the stock are James Dondero’s Highland Capital Management, Zach Schreiber’s Point State Capital, and Anand Parekh’s Alyeska Investment Group.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Biogen Idec Inc. (NASDAQ:BIIB) but similarly valued. These stocks are Mitsubishi UFJ Financial Group Inc (ADR) (NYSE:MTU), Avago Technologies Ltd (NASDAQ:AVGO), Mondelez International Inc (NASDAQ:MDLZ), and Reynolds American, Inc. (NYSE:RAI). This group of stocks’ market caps resemble BIIB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MTU | 16 | 87370 | 4 |

| AVGO | 76 | 8267068 | 2 |

| MDLZ | 53 | 5902162 | -9 |

| RAI | 39 | 1069207 | -1 |

As you can see these stocks had an average of 46 hedge funds with bullish positions and the average amount invested in these stocks was $3.83 billion. That figure was $4.86 billion in BIIB’s case. Avago Technologies Ltd (NASDAQ:AVGO) is the most popular stock in this table. On the other hand Mitsubishi UFJ Financial Group Inc (ADR) (NYSE:MTU) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Biogen Idec Inc. (NASDAQ:BIIB) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None