World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

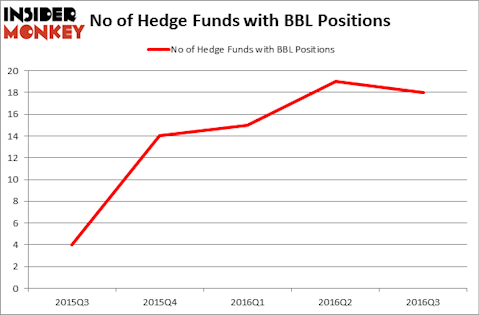

Is BHP Billiton plc (ADR) (NYSE:BBL) an attractive investment right now? Money managers are actually taking a pessimistic view. The number of bullish hedge fund positions experienced a decline of 1 lately. BBL was in 18 hedge funds’ portfolios at the end of September. There were 19 hedge funds in our database with BBL holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Simon Property Group, Inc (NYSE:SPG), Colgate-Palmolive Company (NYSE:CL), and Texas Instruments Incorporated (NASDAQ:TXN) to gather more data points.

Follow Bhp Group (NYSE:BBL)

Follow Bhp Group (NYSE:BBL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Maxx-Studio/Shutterstock.com

Hedge fund activity in BHP Billiton plc (ADR) (NYSE:BBL)

Heading into the fourth quarter of 2016, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a drop of 5% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards BBL over the last 5 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Bernard Horn’s Polaris Capital Management holds the biggest position in BHP Billiton plc (ADR) (NYSE:BBL). Polaris Capital Management has a $120.2 million position in the stock, comprising 9.4% of its 13F portfolio. The second most bullish fund manager is Noam Gottesman of GLG Partners, with a $54.8 million position; the fund has 1.7% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that are bullish comprise Shane Finemore’s Manikay Partners, Israel Englander’s Millennium Management and Paul Singer’s Elliott Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.