The other major microprocessor architecture is the x86 architecture, created by Intel Corporation (NASDAQ:INTC). While Intel Corporation (NASDAQ:INTC) has a near-monopoly on the traditional PC market, ARM has the same on the mobile market. And with PC sales in decline and mobile device sales rising ARM Holdings plc (ADR) (NASDAQ:ARMH) would appear to be in a better position than Intel in terms of growth.

What does ARM actually do?

ARM does not manufacture its own chips, but instead licenses its architecture to chip manufacturers. ARM charges an upfront license fee along with collecting royalties which are typically based on a percentage of the chip price.

This business model leads to extremely high margins, and as the number of licensees increases the company’s profit will increase far faster than the revenue. From 2008 to 2012 revenue grew by about 93%, while the operating profit increased by a factor of nearly 2.5. And with the number of smart phones and tablets being sold each year rising at extraordinary rates ARM Holdings plc (ADR) (NASDAQ:ARMH) should see exceptional growth.

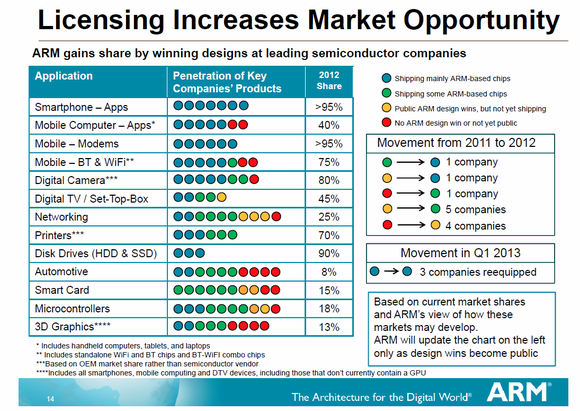

Here’s a chart showing ARM’s market share in various product categories:

ARM maintains a 95%+ market share in smart phones and a dominant market share in various other categories. But there are many categories, like automotive and microcontrollers, in which ARM Holdings plc (ADR) (NASDAQ:ARMH) is just scratching the surface.

ARM’s royalty rate is somewhere around 1.3% of the chip price, although this may vary based on the type of chip and will likely rise in the future. Here’s a graphic directly from ARM showing the opportunity at different price points:

Although there is ample growth possible at all price points, the biggest opportunity in terms of volume is at the low-cost end of the spectrum where the company makes the least per-chip in royalty revenue.

Does Intel have a chance in mobile?

Intel thus far has made little progress in the mobile space, but with the launch of the Haswell architecture right around the corner this could change. The focus of Haswell is efficiency, and this should allow the Windows-based tablets that will contain the chips to offer considerable performance with better battery life than was possible with previous Intel chips.

Being a much larger company than ARM Holdings plc (ADR) (NASDAQ:ARMH), Intel Corporation (NASDAQ:INTC) is spending enormous sums of money to make the size of its transistors smaller and smaller. Intel currently leads the industry with its 22-nm process, and the company plans to make processors using the 14-nm process available in 2014. The biggest benefit of shrinking the size is an increase in power efficiency, something which Intel will need to compete with ARM’s low-power processors in the mobile space.

In the near-term I don’t expect Intel to gain much share in mobile devices. If Windows 8 tablets become popular Intel could take a considerable share of the tablet market, but I think smart phones will remain dominated by ARM for at least the next few years. If Intel can push its manufacturing process down and make its chips much more efficient eventually we could see Intel inside of mainstream smart phones.

Is ARM too expensive?

ARM Holdings plc (ADR) (NASDAQ:ARMH)’s business model allows for spectacular operating margins, 36% in 2012, and the company is truly a cash machine. Since 2008 revenue has grown at an annualized rate of about 18%, while EPS has grown at an annualized rate of nearly 37%. EPS in 2012 was 0.35 GBP, or $0.53, which puts the P/E ratio at about 90.

Can the company possibly grow fast enough to warrant this kind of valuation? The stock has doubled in the last year, and in Q1 of this year the company reported EPS growth of 37.5% year-over-year. If EPS grows by 40% in 2013 the forward P/E ratio would still be a staggering 65.

I don’t doubt that ARM can grow EPS at an extremely high rate for the next few years. But if EPS grows at 40% annually for the next 5 years the stock currently trades at 17 times those 5-year earnings. The most profitable devices for ARM are high-end smart phones and computing devices, and these are the devices which Intel is striving to gain market share. ARM had essentially no competition in these categories since Intel’s offerings weren’t efficient enough, but that could very well change in the coming years.

ARM is trading at a price which assumes that the best-case scenario for ARM is a guarantee. If ARM’s growth slows at any point during the next few years the stock is going to take a nosedive. ARM Holdings plc (ADR) (NASDAQ:ARMH) is a great company with a great business model, and I suspect that ten years from now it will be far more profitable than it is today. But I don’t see much justification for paying 90 times earnings for the company.

A look to the past

There was a time when Advanced Micro Devices, Inc. (NYSE:AMD), competitor to Intel, was trading for around 100 times earnings. In late 2006 AMD peaked at about $42 per share on EPS of $0.40, 60% growth from the year before. Then, as it always does, reality caught up with the stock and it tumbled. Advanced Micro Devices, Inc. (NYSE:AMD) couldn’t compete with Intel, and years of losses followed. Now, AMD trades at about $3.60 per share and is in danger of bankruptcy. ARM is in a far better position than Advanced Micro Devices, Inc. (NYSE:AMD) was in 2006, but you should never count Intel out. The company spent $10 billion on R&D in 2012 along with $11 billion in capital expenditures; combined this is about ARM’s entire inflated market capitalization. One way or another Intel will push its way into the mobile market, threatening ARM’s most lucrative products.

The bottom line

Although ARM’s business model ensures high margins and growth is likely to be high for the next few years the current price tag of 90 times earnings is far too high to pay for the stock. ARM Holdings plc (ADR) (NASDAQ:ARMH) has enjoyed little competition in mobile devices but that will eventually change as Intel produces more power-efficient chips. I don’t doubt that ARM will have much higher earnings ten years from now, but if you pay 90 times today’s earnings you’ll almost certainly be disappointed.

The article Is This Tech Stock Inflated? originally appeared on Fool.com and is written by Timothy Green.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.