We have been waiting for this for a year and finally the third quarter ended up showing a nice bump in the performance of small-cap stocks. Both the S&P 500 and Russell 2000 were up since the end of the second quarter, but small-cap stocks outperformed the large-cap stocks by double digits. This is important for hedge funds, which are big supporters of small-cap stocks, because their investors started pulling some of their capital out due to poor recent performance. It is very likely that equity hedge funds will deliver better risk adjusted returns in the second half of this year. In this article we are going to look at how this recent market trend affected the sentiment of hedge funds towards Allied Motion Technologies, Inc. (NASDAQ:AMOT), and what that likely means for the prospects of the company and its stock.

Is Allied Motion Technologies, Inc. (NASDAQ:AMOT) an outstanding investment right now? Prominent investors seem to be taking a bullish view. Among the funds we track, the number of bullish hedge fund investments went up by two last quarter. At the end of this article we will also compare AMOT to other stocks including Applied Genetic Technologies Corp (NASDAQ:AGTC), ARC Document Solutions Inc (NYSE:ARC), and Travelzoo Inc. (NASDAQ:TZOO) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Zygotehaasnobrain/Shutterstock.com

With all of this in mind, we’re going to take a peek at the new action surrounding Allied Motion Technologies, Inc. (NASDAQ:AMOT).

What have hedge funds been doing with Allied Motion Technologies, Inc. (NASDAQ:AMOT)?

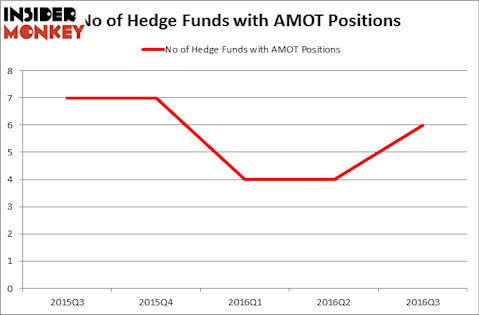

At the end of September, six funds tracked by Insider Monkey held long positions in this stock, up by 50% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards AMOT over the last 5 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, holds the number one position in Allied Motion Technologies, Inc. (NASDAQ:AMOT). Renaissance Technologies has a $1.1 million position in the stock, comprising less than 0.1% of its 13F portfolio. The second most bullish fund manager is Charles Paquelet’s Skylands Capital, which holds a $0.9 million position. Some other hedge funds and institutional investors that hold long positions contain Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, Cliff Asness’ AQR Capital Management, and Zeke Ashton’s Centaur Capital Partners. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.