Intel Corporation (NASDAQ:INTC)’s stock price fell by around 21% in the last year. While the popular analysts’ opinion is that Intel Corporation (NASDAQ:INTC) is a hold, let us dig deeper to learn the full story.

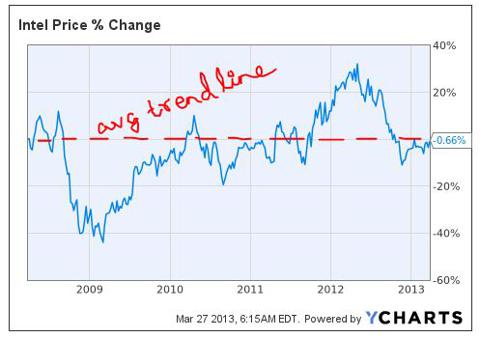

Looking at the price graph below, we can be certain that the stock price is currently below the average trend line. Keeping this in mind, it can be said that Intel Corporation (NASDAQ:INTC)’s price should go up very soon.

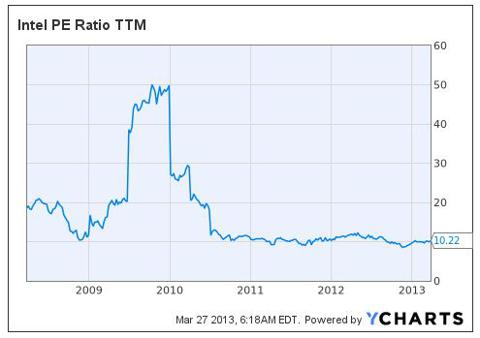

To confirm that, let us take a look at the last five-year P/E ratio (TTM) graph of the company. It seems that the stock is already trading quite cheaply compared with three years ago.

Even when compared with its immediate peers, it seems pretty cheap. Marvell Technology Group Ltd. (NASDAQ:MRVL), QUALCOMM, Inc. (NASDAQ:QCOM) and Broadcom Corporation (NASDAQ:BRCM) seem to be trading at valuations far higher than that of Intel Corporation (NASDAQ:INTC). NVIDIA Corporation (NASDAQ:NVDA) does not seem to be in an investor-friendly state, being doubly hit by the decline in PC sales and surging popularity of Intel Corporation (NASDAQ:INTC)’s Ivy Bridge and Advanced Micro Devices, Inc. (NYSE:AMD)‘s Liano processors.

Regarding Marvell Technology Group Ltd. (NASDAQ:MRVL), big-money investors are shunning the company right now. At the end of the fourth quarter last year, a total of 31 of the hedge funds that I track held long positions in this stock, a decline of 11% from the previous quarter. That should give you a hint about the company’s near future.

In short, Intel Corporation (NASDAQ:INTC) seems viable to me at the moment.

| Companies | Price/Earnings | Price/Sales | Price/Book |

| Intel | 10.2 | 2 | 2.1 |

| Qualcomm | 19.9 | 5.9 | 3.4 |

| STMElectronics ADR | NA | 0.9 | 1.2 |

| NVIDIA | 13.9 | 1.8 | 1.6 |

| Advanced Micro Devices | NA | 0.3 | 3.4 |

| Marvell Tech Group | 19.4 | 1.8 | 1.3 |

| Broadcom Corp. | 27.7 | 2.2 | 2.5 |

Intel is cheap considering that it still owns 8% share of the mobile ICs market as of January (though compared with 52.3% of QUALCOMM, Inc. (NASDAQ:QCOM), it is pretty low though). Additionally, market share of Intel in the PC microchips market increased to 83.3% in Q3 2012, up from 80.6% in the same quarter a year ago.

Meanwhile, for the first time in several years the share of Advanced Micro Devices, Inc. (NYSE:AMD)’s microprocessors on the x86 market dropped to 16.1% from 18.8% in Q3 2011, according to IDG News Service. Market share of Via Technologies was 0.6%. And we can only say that it will rise from here, with Intel’s brand intact in the semiconductors market. Needless to say, this will affect the future P/E ratio of the company positively.

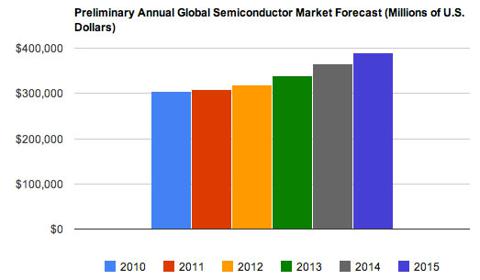

The microprocessor market has come a long way since the Intel 8080 was first introduced in 1974. The global annual semiconductor market is expected to reach nearly $400 billion by the end of 2015.

In short, the semiconductor market is going to grow exponentially in the next couple of years. And needless to say, Intel has the innate brand potential to profit from this action.

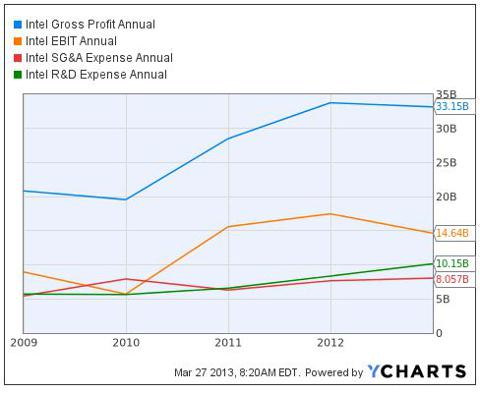

Having talked about the prospective revenue growth of the company, it is time to look at fundamentals a bit.

Intel’s margins did not show enough growth in 2012. That might have led to the sharp decline in the stock price. But, the good news is that Intel has been investing in research and development heavily for the last two years, and it will probably bring in results in the coming few years. Although it might have affected the bottom line in the last couple of years, I would expect the trend to reverse in the next two years.

Having said that, it should be reiterated that the profitability margins are still better than the rest. Take a look at the table below. It is obvious that Intel is ahead of the competition (except for QUALCOMM, Inc. (NASDAQ:QCOM), of course) when it comes to profitability.

| Companies | Return On Investment % | Gross Margin % | Operating Margin % | Net Margin % |

| Intel Corp. | 16.9 | 62.2 | 27.4 | 20.6 |

| Qualcomm, Inc. | 15.4 | 62.9 | 29.3 | 27.6 |

| STMElectronics ADR | 8.2 | 49.7 | 8.4 | 8.9 |

| Nvidia Corp. | 11.2 | 52 | 15.2 | 13.1 |

| Advanced Micro Devices | (40.9) | 22.8 | (19.6) | (21.8) |

| Marvell Tech Group | 6.24 | 52.9 | 9.3 | 9.7 |

| Broadcom Corp. | (25.9) | 31.9 | (24.5) | (25.8) |

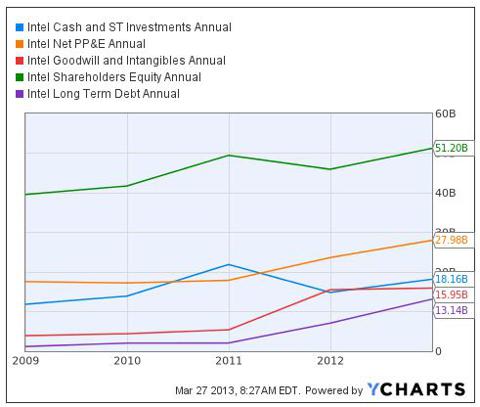

Intel’s balance sheet boasts of increasing net plant, property and equipment worth $28 billion as of January. All these heavy capital expenditures will reap benefits for years to come. Although there have been instances of surging long-term debt, we can rest assured of the fact that it is ‘long’ in term. That will cut the company some slack to amortize the debt right away.

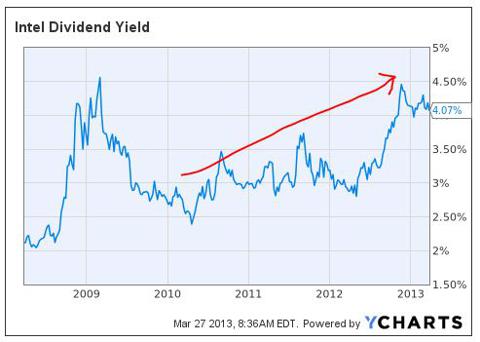

And what’s better is that Intel’s dividend yield rose to above 4% over the last three years. This again confirms that the stock price has a strong chance to soar.

To sum it up, I would say Intel is a buy at the moment. Don’t expect a huge price rise in the short term, though. Considering the strong fundamentals, higher mobile-oriented focus and concern of shareholders’ interests, Intel seems to be value buy. And, with better market performance in the next year or two, the price should shoot up immensely.