Even mobile chip manufacturers are finding it hard to fight the bears. Just like Intel Corporation (NASDAQ:INTC) had to suffer the consequences of a shrinking PC market, more and more investors see QUALCOMM, Inc. (NASDAQ:QCOM) as a potential disaster in the making, due to the high exposure of core revenue to the mobile industry.

But unlike Intel Corporation (NASDAQ:INTC) at its highest times, QUALCOMM, Inc. (NASDAQ:QCOM) is far from being overvalued. Trading at a price earnings ratio of only 13, safe royalties coming from CDMA-based 3G wireless networks, excellent processor chips (Snapdragon), a growing dividend and aggressive buy backs, Qualcomm may be the cheapest chip manufacturer at the moment. As the market discovers the hidden true value of Qualcomm in the next months and bear feelings fade away, the past 52 weeks’ mild 13% return could be offset by a great margin.

Source: Morningstar

The bull case

The bull case is pretty easy to understand. The latest earnings call showed that despite worries of a possible contraction in the global demand for smartphones, QUALCOMM, Inc. (NASDAQ:QCOM) not only keeps delivering strong growth figures: it is also not afraid of providing an optimistic guidance for the next quarter. In the third-quarter earnings call, Qualcomm reported $6.24 billion for revenue, up 35% from the year-ago quarter and at the top of its projected $5.8 billion to $6.3 billion interval. The chip business was up 8% sequentially and revenue per unit also rose 8% sequentially due to a mix of LTE baseband chips and new Snapdragon processors.

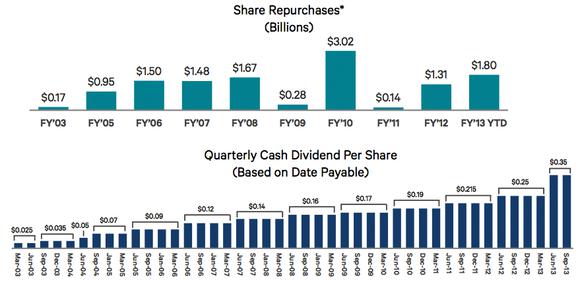

Source: Qualcomm Investors Relations

Everything looks great on the revenue side. The current trend is likely to continue for the next two quarters due to the outperforming Snapdragon processors and Apple Inc. (NASDAQ:AAPL)‘s next iPhone introduction. But, even better, QUALCOMM, Inc. (NASDAQ:QCOM) is also active in share repurchases and has a growing dividend. It bought back almost $1.5 billion in stock in 2012, and has authorization from management to buy back an additional $2.5 billion in the future.

On the balance sheet side, everything looks pretty too. The current stock price is approximately $66 per share, of which $15 are backed up with cash. In this way, both naturally and artificially, revenue, operating income and EPS are all set to grow!

Source: Qualcomm Investors Relations

So what does the sell-side & research analysts think about QUALCOMM, Inc. (NASDAQ:QCOM)? Morningstar provides a $75 fair price estimate, based on improved near-term revenue and margins. Morgan Stanely ($78), The Street ($75), Raymond James ($89), Cannacord ($84) and Nomura Securities ($78) all seem to agree in one thing: at $66 per share, Qualcomm is a clear bargain. These price estimates suggest a higher potential upside than Intel Corporation (NASDAQ:INTC).

The bear case

Bears are mainly worried about two things. First, competition in the fierce chip business is increasing, and this will have a negative effect on gross margin. So far, QUALCOMM, Inc. (NASDAQ:QCOM) has managed to protect its margins because it has been the first one to develop certain products lilke multimode LTE modems for phones. The problem is that competitors like Intel Corporation (NASDAQ:INTC) and Broadcom Corporation (NASDAQ:BRCM) will, sooner or later, catch up.

Another bearish argument emphasizes that the biggest mobile chip consumers are showing signs of early exhaustion. This brings us to the second point: QUALCOMM, Inc. (NASDAQ:QCOM) is just too dependent on certain customers. Samsung, for example, contributes about 10% of Qualcomm’s sales. A decrease in sales of Samsung devices will almost certainly directly translate into a decline in Qualcomm’s revenue.

However, we shouldn’t underestimate QUALCOMM, Inc. (NASDAQ:QCOM)’s competitive advantages. First of all, compared with Intel Corporation (NASDAQ:INTC), Qualcomm can benefit more from economies of scale, because with $20.46 billion in sales, Qualcomm is still less than half of Intel’s size. Also, don’t forget that Intel’s strength lies in the PC segment, and it ignored the mobile market for a long time.