Of all the industries you could start a business in, IT products distribution is probably the last I would recommend. Low margins, cutthroat competition, and high supplier bargaining power make this as unattractive an industry as you can find.

However, while I wouldn’t say some companies thrive in this industry, it is clear that a few have found a way to make more money than most.

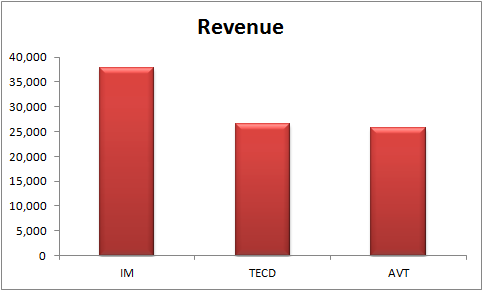

The most attractive profitable company in this industry is Ingram Micro Inc. (NYSE:IM). Ingram Micro is the largest IT products distributor in the world and is set to exceed $40 billion in sales in 2013. It has a size-able lead over its two biggest competitors, Avnet, Inc. (NYSE:AVT) and Tech Data Corp (NASDAQ:TECD).

Tech Data Corp (NASDAQ:TECD) is the second-largest IT product distributor, having reclaimed the position after briefly giving it up to Avnet, Inc. (NYSE:AVT). But there is no doubt who will remain the biggest in the industry for years to come — Ingram Micro Inc. (NYSE:IM)’s size confers scale advantages that the other two companies cannot directly compete with.

Instead of going head to head with Ingram Micro on all fronts, Tech Data Corp (NASDAQ:TECD) and Avnet, Inc. (NYSE:AVT) have been pursuing small- and medium-sized businesses. Still, the two companies’ strategies are quite different.

Avnet, Inc. (NYSE:AVT) grows primarily through smart acquisitions and seamlessly integrating them into the company — a strategy which has proven quite profitable over the last few years.

Meanwhile, Tech Data Corp (NASDAQ:TECD) is focused on improving margins from within and returning cash flow to shareholders.

A Brutal Business

No matter how different the top three companies’ strategies, the competition remains brutal. A quick look at gross margins is enough to keep any new entrant out of the market.

Avnet has managed a significantly higher gross margin — albeit only 12% — due to a different offering. But it’s safe to say that margins are pretty darn low for everyone in this industry.

This is why Ingram Micro Inc. (NYSE:IM)’s stock price is down in the dumps right now. Tech spending is expected to be lower-than-normal for the foreseeable future and the company has had some major issues coming out of its Australian operations. In addition, investors are skeptical as to whether management can achieve projected synergies with the company’s recent acquisition of BrightPoint.

All of these factors, in addition to razor thin margins as the norm, contribute to a low share price for Ingram Micro Inc. (NYSE:IM). However, although the North American market will not be of much help going forward, the company’s operations in Asia and Latin America provide a long runway for growth. In addition, Ingram Micro Inc. (NYSE:IM) is dabbling in cloud services, which could end up raising the company’s overall margins.

Valuation

Ingram Micro Inc. (NYSE:IM) currently trades at 0.83x book value despite having historically earned an 8.5% return on equity during “normal” years. Although it is possible that the company will earn a lower return on equity over the next year, the company’s long-term growth prospects in emerging markets and investments in its cloud services business suggest the company will do better in the future than it has in the past. Thus, investors who buy below 85% of book value could easily end up with an annualized return in excess of 10%

The article This Global IT Products Distributor Is Set to Take Off originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.