This year Vanguard became the largest mutual fund family. They preach that index investing beats stock picking and market timing. The truth is that there are several easy ways to beat index funds. You can beat the S&P 500 index funds by more than 11% annually by following mutual fund flow data, for example. We at Insider Monkey have been showing you how to make high returns by using novel investor sentiment data, like the Roubini Sentiment Indicator or the Permabear Sentiment Index. Stock prices don’t always reflect the true fundamentals. In the short run, investor sentiment and funds flowing in and out of the stock market have a bigger say in the direction of prices. Let me say that again in other words: don’t trust that stocks are priced correctly in the short run. When permabears Roubini, Schiff, or Faber dampen investor enthusiasm by their comments, investors decide to pull their funds out of the stock market. When permabulls dominate the news cycle, investors decide to put more funds into the stock market. One way of following investor sentiment is using our permabear sentiment index; another way is by following mutual fund flow data provided by Investment Company Institute.

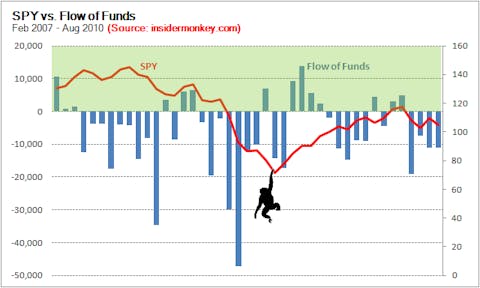

The correlation coefficient between the S&P 500 returns and the monthly funds flowing in and out of the mutual funds is 0.52. Between February 2007 and August 2010, the SPY (an index fund tracking the S&P 500 index) returned an average monthly return of 1.85% when there was an inflow of funds. When there was an outflow of funds, the SPY returned an average return of -1.48% during the same time period. These are amazing numbers. You could be the next Warren Buffett if you had a way of knowing the fund flows in advance or in real-time. In fact, the Permabear Sentiment Index predicts this indirectly.

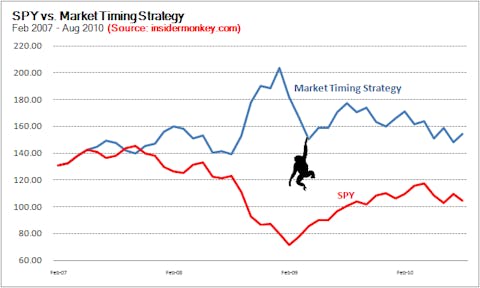

Mutual fund companies have this valuable data in real-time, and they publish weekly fund flow estimates with a 2-week lag. This means, by the end of each month we pretty much know whether we have positive or negative fund flows during that month. Can we still make large returns even though we have delayed access to the fund flow data? Insider Monkey’s analysis shows that we can still achieve an annual 11% return over SPY when we utilize the previous month’s fund flow data. Our investment strategy is very simple. When there is an inflow of funds during the previous month, we go long the SPY for a month. When there is an outflow of funds, we sell the SPY short for a month.

Excellent Results: During the past 3.5 years the SPY returned an average of -0.4% per month. This is our benchmark. When there was an inflow of funds during the previous month, the SPY returned an average of 0.15% per month. When there was an outflow of funds during the previous month, SPY returned an average of -0.69%. Overall, our strategy returned an average monthly return of 0.50% per month compared to -0.40% per month for our benchmark. This means that our strategy beats an average John Bogle Vanguard investor by 0.9% per month or by 11.3% annually during the past 3.5 years. Find out more about how to beat index funds at Insider Monkey, your source for free real-time insider trading data.