Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30. What do these smart investors think about Sumitomo Mitsui Financial Grp, Inc. (ADR) (NYSE:SMFG)?

Sumitomo Mitsui Financial Grp, Inc. (ADR) (NYSE:SMFG) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 10 hedge funds’ portfolios at the end of the third quarter of 2016. At the end of this article we will also compare SMFG to other stocks including Twenty-First Century Fox Inc (NASDAQ:FOX), Prudential Public Limited Company (ADR) (NYSE:PUK), and Las Vegas Sands Corp. (NYSE:LVS) to get a better sense of its popularity.

Follow Sumitomo Mitsui Financial Gp Inc (NYSE:SMFG)

Follow Sumitomo Mitsui Financial Gp Inc (NYSE:SMFG)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Mikko Lemola/Shutterstock.com

How have hedgies been trading Sumitomo Mitsui Financial Grp, Inc. (ADR) (NYSE:SMFG)?

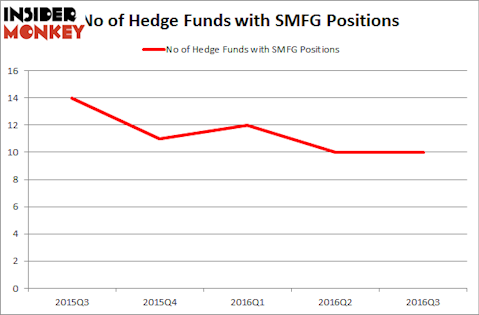

At Q3’s end, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in SMFG over the last 5 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, William B. Gray’s Orbis Investment Management has the biggest position in Sumitomo Mitsui Financial Grp, Inc. (ADR) (NYSE:SMFG), worth close to $12.4 million. Coming in second is Renaissance Technologies, one of the biggest hedge funds in the world, which holds a $10.7 million position. Other hedge funds and institutional investors that hold long positions comprise D. E. Shaw’s D E Shaw, Glenn Russell Dubin’s Highbridge Capital Management and Charles Davidson’s Wexford Capital. We should note that Orbis Investment Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.