Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

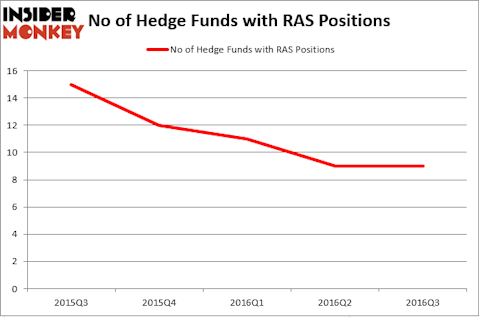

RAIT Financial Trust (NYSE:RAS) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 9 hedge funds’ portfolios at the end of the third quarter of 2016, same as at the end of the second quarter. At the end of this article we will also compare RAS to other stocks including Straight Path Communications Inc (NYSEMKT:STRP), Primero Mining Corp (NYSE:PPP), and Idera Pharmaceuticals Inc (NASDAQ:IDRA) to get a better sense of its popularity.

Follow Rait Financial Trust (NYSE:RASFQ)

Follow Rait Financial Trust (NYSE:RASFQ)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Nonwarit/Shutterstock.com

What does the smart money think about RAIT Financial Trust (NYSE:RAS)?

Heading into the fourth quarter of 2016, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from one quarter earlier. On the other hand, there were a total of 12 hedge funds with a bullish position in RAS at the beginning of this year, which has since declined by 25%. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Tricadia Capital Management, led by Michael Barnes and Arif Inayatullah, holds the number one position in RAIT Financial Trust (NYSE:RAS). Tricadia Capital Management has a $22.4 million position in the stock, comprising 6.2% of its 13F portfolio. On Tricadia Capital Management’s heels is James Dondero of Highland Capital Management, with a $20 million position. Other professional money managers that hold long positions contain Renaissance Technologies, one of the largest hedge funds in the world, Chuck Royce’s Royce & Associates, and Israel Englander’s Millennium Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Let’s go over hedge fund activity in other stocks similar to RAIT Financial Trust (NYSE:RAS). We will take a look at Straight Path Communications Inc (NYSEMKT:STRP), Primero Mining Corp (NYSE:PPP), Idera Pharmaceuticals Inc (NASDAQ:IDRA), and Reading International, Inc. (NASDAQ:RDI). This group of stocks’ market values resemble RAS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STRP | 7 | 30791 | -1 |

| PPP | 5 | 2969 | -4 |

| IDRA | 9 | 30977 | 2 |

| RDI | 7 | 15135 | 3 |

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $20 million. That figure was $56 million in RAS’s case. Idera Pharmaceuticals Inc (NASDAQ:IDRA) is the most popular stock in this table. On the other hand Primero Mining Corp (NYSE:PPP) is the least popular one with only 5 bullish hedge fund positions. RAIT Financial Trust (NYSE:RAS) is tied as the most popular stock in this group. This is a positive signal, as we’d rather spend our time researching stocks that hedge funds are piling on. In this regard IDRA and RAS might be good candidates to consider taking long positions in.

Disclosure: None