After a frantic weekend in September of 2008 during which investment banks scrambled for suitors in a desperate attempt to avoid the fate of Lehman Brothers, Bank of America Corp (NYSE:BAC), the nation’s largest consumer bank at the time, agreed to buy Merrill Lynch, its counterpart in the retail brokerage and wealth management realms.

The move was heralded as a coup for the bank’s 61-year-old chairman and chief executive officer. “Ken Lewis with this transaction just got that much more powerful in the global financial structure,” Meredith Whitney told The New York Times five years ago. “If Mr. Lewis has long clamored for the respect of the banking industry’s more established leaders,” the paper went on to note, “he appears to have emerged from the deal as one of Wall Street’s white knights.”

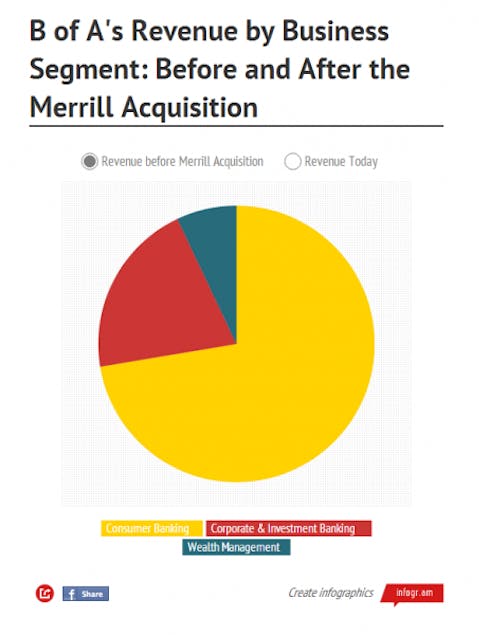

For Bank of America Corp (NYSE:BAC), the acquisition was transformative in every sense of the word. In one fell swoop, it morphed from a stodgy, backwater lender that catered to the masses into a world-class universal bank with more than $2 trillion in assets on its balance sheet. It already had the nation’s largest branch network and led the industry in credit card issuance, mortgage underwriting, and auto loans. Now it also had an industry-leading investment bank and the world’s largest wealth-management operations.

But as time has passed, it’s also become increasingly clear that the narrative casting Bank of America Corp (NYSE:BAC) as the savior of Merrill Lynch, its white knight, is much more nuanced.

In the days and weeks that followed, there was little doubt that it gave Merrill a second lease on life. Had the North Carolina-based lender not stepped in, it’s almost certain the listing investment bank would have failed. It was egregiously undercapitalized at the time and had tens of billions of dollars’ worth of exposure to toxic collateralized debt obligations backed by subprime mortgages.

And had Bank of America Corp (NYSE:BAC) not stepped in when it did, Merrill’s shareholders very well could have been left with nothing. The deal inked over that fateful weekend in September included a $50 billion price tag, in which Merrill’s stakeholders got 0.8595 shares of Bank of America Corp (NYSE:BAC) common stock for each Merrill Lynch common share. “In retrospect, [Lewis] should have waited until Monday,” CNNMoney’s Shawn Tully said, “when he stood an excellent chance of bagging Merrill for a fraction of that price.”

In the five years since, however, the tables have turned. Bank of America Corp (NYSE:BAC) has been weighed down by bad loans and litigation dating back to the financial crisis. Altogether, its consumer banking segments — encompassing deposits, credit cards, and home lending, among other things — have lost $29 billion since 2008. Its consumer real estate segment has alone lost $41.2 billion over that time period.

Meanwhile, its commercial and investment banking operations, as well as its wealth management unit — most of which came via Merrill — have flourished. Combined, they’ve accounted for $40.2 billion in income. Without Merrill’s contribution, in other words, Bank of America would have recorded a net operating loss over the last five years of somewhere in the range of $29 billion as opposed to the $11 billion in profit it notched instead.

The Foolish bottom line

Far from emerging from the financial crisis as a mere shell of its former self, as one might have expected given its acquisition of Countrywide Financial earlier in 2008, Bank of America Corp (NYSE:BAC) has indeed become the premier financial services franchise Ken Lewis envisioned. With more than $2 trillion in assets on its balance sheet and a comparable amount of assets under management, it’s hard to envision a future that isn’t ripe with opportunity for the megabank. Now, of course, whether it profitably exploits this remains to be seen.

The article How Merrill Lynch Became Bank of America’s Unlikely Savior originally appeared on Fool.com and is written by John Maxfield.

John Maxfield owns shares of Bank of America. The Motley Fool recommends Bank of America. The Motley Fool owns shares of Bank of America.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.