Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like China Mobile Ltd. (ADR) (NYSE:CHL) .

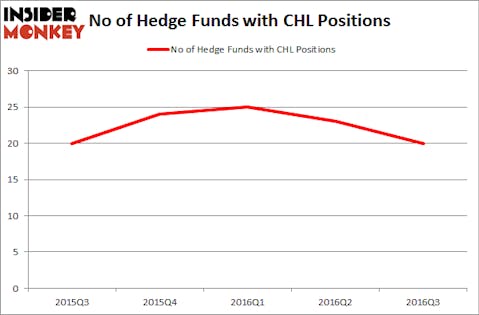

China Mobile Ltd. (ADR) (NYSE:CHL) investors should be aware of a decrease in support from the world’s most successful money managers lately. At the end of September, there were, 20 funds tracked by Insider Monkey long the stock, compared to 23 funds a quarter earlier. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a decline in popularity but it may still be more popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Verizon Communications Inc. (NYSE:VZ), Wal-Mart Stores, Inc. (NYSE:WMT), and JPMorgan Chase & Co. (NYSE:JPM) to gather more data points.

Follow China Mobile Ltd (NYSE:CHL)

Follow China Mobile Ltd (NYSE:CHL)

Receive real-time insider trading and news alerts

solarseven/Shutterstock.com

Keeping this in mind, we’re going to review the latest action regarding China Mobile Ltd. (ADR) (NYSE:CHL).

How have hedgies been trading China Mobile Ltd. (ADR) (NYSE:CHL)?

A total of 20 of the hedge funds tracked by Insider Monkey held long positions in China Mobile at the end of September, down by 13% over the quarter. Below, you can check out the change in hedge fund sentiment towards CHL over the last five quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’ Renaissance Technologies has the biggest position in China Mobile Ltd. (ADR) (NYSE:CHL), worth close to $140.1 million, corresponding to 0.2% of its total 13F portfolio. The second largest stake is held by Indus Capital, led by David Kowitz and Sheldon Kasowitz, holding a $47.4 million position; 4.5% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that are bullish contain John W. Rogers’s Ariel Investments, Ken Hahn’s Quentec Asset Management and Noam Gottesman’s GLG Partners. We should note that Indus Capital is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.