Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index returned about 7.6% during the last 12 months ending November 21, 2016. Most investors don’t notice that less than 49% of the stocks in the index outperformed the index. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 30 mid-cap stocks among the best performing hedge funds had an average return of 18% during the same period. Hedge funds had bad stock picks like everyone else. We are sure you have read about their worst picks, like Valeant, in the media over the past year. So, taking cues from hedge funds isn’t a foolproof strategy, but it seems to work on average. In this article, we will take a look at what hedge funds think about China Life Insurance Company Ltd. (ADR) (NYSE:LFC).

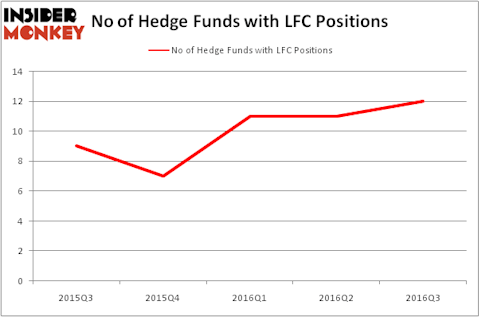

China Life Insurance Company Ltd. (ADR) (NYSE:LFC) investors should pay attention to an increase in support from the world’s most successful money managers lately. There were 11 hedge funds in our database with LFC positions at the end of the previous quarter. At the end of this article we will also compare LFC to other stocks including U.S. Bancorp (NYSE:USB), Charter Communications, Inc. (NASDAQ:CHTR), and Priceline.com Inc (NASDAQ:PCLN) to get a better sense of its popularity.

Follow China Life Insurance Co Ltd (NYSE:LFC)

Follow China Life Insurance Co Ltd (NYSE:LFC)

Receive real-time insider trading and news alerts

nito/Shutterstock.com

Keeping this in mind, we’re going to take a look at the latest action surrounding China Life Insurance Company Ltd. (ADR) (NYSE:LFC).

How are hedge funds trading China Life Insurance Company Ltd. (ADR) (NYSE:LFC)?

Heading into the fourth quarter of 2016, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, up 9% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards LFC over the last 5 quarters. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners has the largest position in China Life Insurance Company Ltd. (ADR) (NYSE:LFC), worth close to $24.9 million, amounting to 2.4% of its total 13F portfolio. The second most bullish fund manager is Segantii Capital, led by Simon Sadler, holding a $10.2 million position; the fund has 2.8% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions encompass Michael Platt and William Reeves’s BlueCrest Capital Mgmt., John Overdeck and David Siegel’s Two Sigma Advisors and Matthew Hulsizer’s PEAK6 Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. PEAK6 Capital Management, led by Matthew Hulsizer, created the most valuable call position in China Life Insurance Company Ltd. (ADR) (NYSE:LFC). According to regulatory filings, the fund had $1.6 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.4 million position during the quarter. The other funds with new positions in the stock are Richard Driehaus’s Driehaus Capital, Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital, and Louis Navellier’s Navellier & Associates.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as China Life Insurance Company Ltd. (ADR) (NYSE:LFC) but similarly valued. We will take a look at U.S. Bancorp (NYSE:USB), Charter Communications, Inc. (NASDAQ:CHTR), Priceline.com Inc (NASDAQ:PCLN), and Lockheed Martin Corporation (NYSE:LMT). This group of stocks’ market values are similar to LFC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| USB | 41 | 4631330 | -7 |

| CHTR | 112 | 18469027 | -22 |

| PCLN | 98 | 8188039 | 13 |

| LMT | 34 | 755807 | -5 |

As you can see these stocks had an average of 71 hedge funds with bullish positions and the average amount invested in these stocks was $8.01 billion. That figure was a meager $48 million in LFC’s case. Charter Communications, Inc. (NASDAQ:CHTR) is the most popular stock in this table. On the other hand Lockheed Martin Corporation (NYSE:LMT) is the least popular one with only 34 bullish hedge fund positions. Compared to these stocks China Life Insurance Company Ltd. (ADR) (NYSE:LFC) is even less popular than LMT. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: none.