Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those successful funds in these small-cap stocks. In the following paragraphs, we analyze Arbor Realty Trust, Inc. (NYSE:ABR) from the perspective of those successful funds.

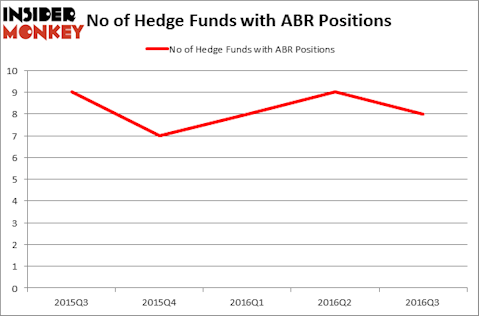

Arbor Realty Trust, Inc. (NYSE:ABR) shareholders have witnessed a decrease in hedge fund sentiment in recent months. ABR was in 8 hedge funds’ portfolios at the end of the third quarter of 2016. There were 9 hedge funds in our database with ABR holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as The York Water Company (NASDAQ:YORW), Moneygram International Inc (NYSE:MGI), and IXYS Corporation (NASDAQ:IXYS) to gather more data points.

Follow Arbor Realty Trust Inc (NYSE:ABR)

Follow Arbor Realty Trust Inc (NYSE:ABR)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

ZIDO SUN/Shutterstock.com

Hedge fund activity in Arbor Realty Trust, Inc. (NYSE:ABR)

At the end of the third quarter, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a decrease of 11% from one quarter earlier. By comparison, 7 hedge funds held shares or bullish call options in ABR heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, holds the most valuable position in Arbor Realty Trust, Inc. (NYSE:ABR). Renaissance Technologies has a $2.7 million position in the stock. Coming in second is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $1.9 million position. Remaining professional money managers that hold long positions comprise D. E. Shaw’s D E Shaw, Israel Englander’s Millennium Management and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Judging by the fact that Arbor Realty Trust, Inc. (NYSE:ABR) has sustained falling interest from the smart money, it’s safe to say that there is a sect of money managers who were dropping their entire stakes by the end of the third quarter. Interestingly, Dmitry Balyasny’s Balyasny Asset Management dropped the largest investment of all the investors tracked by Insider Monkey, valued at close to $0.3 million in stock. Ben Levine, Andrew Manuel and Stefan Renold’s fund, LMR Partners, also dumped its stock, about $0.2 million worth.

Let’s now take a look at hedge fund activity in other stocks similar to Arbor Realty Trust, Inc. (NYSE:ABR). These stocks are The York Water Company (NASDAQ:YORW), Moneygram International Inc (NYSE:MGI), IXYS Corporation (NASDAQ:IXYS), and Tesco Corporation (USA) (NASDAQ:TESO). All of these stocks’ market caps resemble ABR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| YORW | 5 | 11670 | -2 |

| MGI | 14 | 71941 | -1 |

| IXYS | 11 | 37606 | -1 |

| TESO | 7 | 41070 | -4 |

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $41 million. That figure was $9 million in ABR’s case. Moneygram International Inc (NYSE:MGI) is the most popular stock in this table. On the other hand The York Water Company (NASDAQ:YORW) is the least popular one with only 5 bullish hedge fund positions. Arbor Realty Trust, Inc. (NYSE:ABR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MGI might be a better candidate to consider taking a long position in.

Disclosure: None