One of the best ways to outperform the broader market is to follow hedge funds into some of their picks. Generally, a good strategy is to follow activist investors, since they don’t wait for a stock to gain value, but create catalysts that spur growth. Having said that, let’s take a closer look at Advance Auto Parts, Inc. (NYSE:AAP), Darden Restaurants, Inc. (NYSE:DRI), and WestRock Co (NYSE:WRK), and Brink’S Co (NYSE:BCO), which were among the top stock picks of the notorious activist Jeff Smith‘s Starboard Value.

At Insider Monkey, we follow around 750 investors and we calculate their returns based on their long stock positions in companies worth at least $1.0 billion. In Starboard’s case, our methodology showed that the fund gained 12.30% during the third quarter, based on 15 “relevant” holdings it had reported as of the end of June.

With this in mind, let’s move on to discussing the performance of some of Jeff Smith’s top investments.

In Advance Auto Parts, Inc. (NYSE:AAP), Starboard held 2.76 million shares worth $445.29 million at the end of June, after having increased the stake by 61% during the second quarter. The investment didn’t really pay off, as the stock slid by 7.7% during the third quarter. Back in September, Starboard issued a presentation, where it outlined some points that could increase the company’s value, including increasing margins, unlocking value from an “underappreciated asset” and “pursuing future industry consolidation”. Starboard also believes that the stock could went up to at least $350 per share. Overall, 51 funds tracked by Insider Monkey held shares of Advance Auto Parts, Inc. (NYSE:AAP) at the end of June, up by 11% over the quarter. Starboard held the largest stake, followed by Citadel Investment Group which amassed $229.9 million worth of shares. Moreover, Fir Tree, Balyasny Asset Management, and Marshall Wace LLP were also bullish on Advance Auto Parts, Inc. (NYSE:AAP).

Follow Advance Auto Parts Inc (NYSE:AAP)

Follow Advance Auto Parts Inc (NYSE:AAP)

Receive real-time insider trading and news alerts

Then there’s Darden Restaurants, Inc. (NYSE:DRI), in which Starboard cut its stake by 41% to 3.89 million shares worth $246.39 million at the end of the second quarter. The stock inched down by 2.3% in the following three months. However, it’s important to mention that Darden is one of Starboard’s most successful investments, since the fund managed to reshuffle the company’s entire board and to unlock substantial value following a fierce activist campaign. During the second quarter, the number of funds from our database long Darden Restaurants declined by 18% to 31. Trailing Starboard, which was also the largest shareholder of Darden Restaurants, Inc. (NYSE:DRI), was AQR Capital Management with a $199.5 million position. Other investors bullish on the company included HBK Investments, Gotham Asset Management, and Renaissance Technologies.

Follow Darden Restaurants Inc (NYSE:DRI)

Follow Darden Restaurants Inc (NYSE:DRI)

Receive real-time insider trading and news alerts

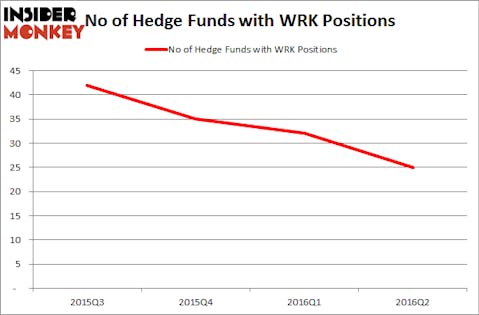

Then there’s WestRock Co (NYSE:WRK), which was one of Starboard’s most profitable investments last quarter, as the stock surged by 25.8%. During the second quarter, the fund increased its exposure to WestRock by 12% to 5.14 million shares valued at $199.84 million. Moreover, 25 funds followed by our team reported stakes in the company as of the end of June, down by 22% over the quarter. Aside from Starboard, Lakewood Capital Management, managed by Anthony Bozza, amassed $88.5 million worth of company’s stock at the end of the second quarter. Moreover, Curtis Macnguyen’s Ivory Capital (Investment Mgmt), Ken Griffin’s Citadel Investment Group and Thomas E. Claugus’s GMT Capital, also ranked among WestRock Co (NYSE:WRK)’s top shareholders.

Follow Wrkco Inc. (NYSE:WRK)

Follow Wrkco Inc. (NYSE:WRK)

Receive real-time insider trading and news alerts

Even a higher return, Starboard saw from its bet on Brink’S Co (NYSE:BCO), whose stock appreciated by 30.6% during the third quarter. At the end of June, Starboard held a $130.45 million position, which contained 4.58 million shares. There were 24 investors from our database holding shares of Brink’S at the end of June, up by one over the quarter. On the second spot (following Starboard) was Mario Gabelli’s GAMCO Investors with a $64.6 million position. Other investors bullish on the Brink’S Co (NYSE:BCO) included Sagard Capital Partners Management Corp, Ariel Investments, and Diamond Hill Capital.

Follow Brinks Co (NYSE:BCO)

Follow Brinks Co (NYSE:BCO)

Receive real-time insider trading and news alerts

Disclosure: none