Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those successful funds in these small-cap stocks. In the following paragraphs, we analyze Ryerson Holding Corp (NYSE:RYI) from the perspective of those successful funds.

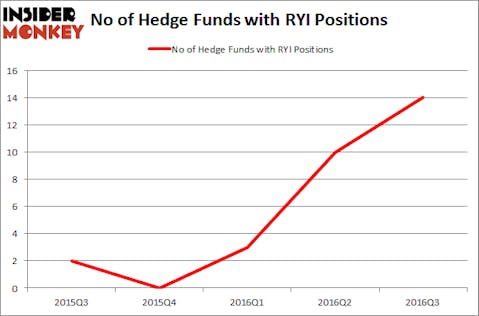

Is Ryerson Holding Corp (NYSE:RYI) ready to rally soon? Prominent investors are genuinely in a bullish mood. The number of bullish hedge fund positions that are disclosed in regulatory 13F filings improved by 4 lately. RYI was in 14 hedge funds’ portfolios at the end of the third quarter of 2016. There were 10 hedge funds in our database with RYI positions at the end of the previous quarter. At the end of this article we will also compare RYI to other stocks including Daktronics, Inc. (NASDAQ:DAKT), China Online Education Group ADR (NYSE:COE), and Entellus Medical Inc (NASDAQ:ENTL) to get a better sense of its popularity.

Follow Ryerson Holding Corp (NYSE:RYZ)

Follow Ryerson Holding Corp (NYSE:RYZ)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Photology1971/Shutterstock.com

With all of this in mind, let’s take a glance at the recent action surrounding Ryerson Holding Corp (NYSE:RYI).

What have hedge funds been doing with Ryerson Holding Corp (NYSE:RYI)?

Heading into the fourth quarter of 2016, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, an increase of 40% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards RYI over the last 5 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Cliff Asness’ AQR Capital Management has the largest position in Ryerson Holding Corp (NYSE:RYI), worth close to $12.1 million, corresponding to less than 0.1% of its total 13F portfolio. Coming in second is Renaissance Technologies, one of the largest hedge funds in the world, holding a $9.9 million position; the fund has less than 0.1% of its 13F portfolio invested in the stock. Remaining peers that are bullish comprise John Overdeck and David Siegel’s Two Sigma Advisors, D.E. Shaw’s D E Shaw, and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Omega Advisors, led by Leon Cooperman, created the biggest position in Ryerson Holding Corp (NYSE:RYI). Omega Advisors had $1.5 million invested in the company at the end of the quarter. Glenn Russell Dubin’s Highbridge Capital Management also made a $1 million investment in the stock during the quarter. The other funds with new positions in the stock are Israel Englander’s Millennium Management, and Michael Platt and William Reeves’ BlueCrest Capital Mgmt..

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Ryerson Holding Corp (NYSE:RYI) but similarly valued. We will take a look at Daktronics, Inc. (NASDAQ:DAKT), China Online Education Group (NASDAQ:COE), Entellus Medical Inc (NASDAQ:ENTL), and Servicesource International Inc (NASDAQ:SREV). All of these stocks’ market caps are closest to RYI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DAKT | 14 | 16178 | 5 |

| COE | 5 | 15155 | -1 |

| ENTL | 4 | 13890 | -3 |

| SREV | 12 | 144800 | 0 |

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $48 million. That figure was $35 million in RYI’s case. Daktronics, Inc. (NASDAQ:DAKT) is the most popular stock in this table. On the other hand Entellus Medical Inc (NASDAQ:ENTL) is the least popular one with only 4 bullish hedge fund positions. Ryerson Holding Corp (NYSE:RYI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard DAKT might be a better candidate to consider taking a long position in.

Disclosure: none