Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility and underperformance. The time period between the end of June 2015 and the end of June 2016 was one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500. Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility and underperformance. The time period between the end of June 2015 and the end of June 2016 was one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have been underperforming the large-cap indices. However, things have dramatically changed over the last 5 months. Small-cap stocks reversed their misfortune and beat the large cap indices by almost 11 percentage points since the end of June.

In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Open Text Corporation (USA) (NASDAQ:OTEX). In addition, at the end of this article we will also compare OTEX to other stocks including Western Gas Partners, LP (NYSE:WES), ITC Holdings Corp. (NYSE:ITC), and Ashland Inc. (NYSE:ASH) to get a better sense of its popularity.

Follow Open Text Corp (NASDAQ:OTEX)

Follow Open Text Corp (NASDAQ:OTEX)

Receive real-time insider trading and news alerts

Today there are many formulas market participants can use to value their stock investments. Some of the best formulas are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the best picks of the best fund managers can outclass the S&P 500 by a superb amount (see the details here).

Production Perig/Shutterstock.com

Now, we’re going to review the latest action surrounding Open Text Corporation (USA) (NASDAQ:OTEX).

How have hedgies been trading Open Text Corporation (USA) (NASDAQ:OTEX)?

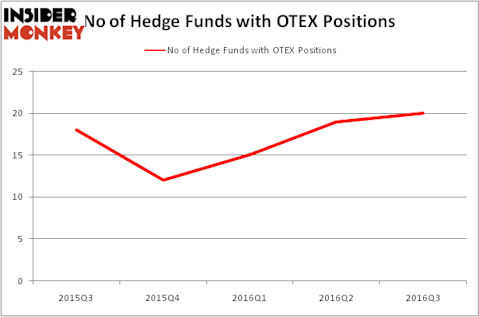

At the end of the third quarter, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, up by one fund from the second quarter. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the largest position in Open Text Corporation (USA) (NASDAQ:OTEX), worth close to $47.8 million, amounting to 0.2% of its total 13F portfolio. The second most bullish fund manager is AQR Capital Management, led by Cliff Asness, holding a $27.7 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that hold long positions include Craig C. Albert’s Sheffield Asset Management, Robert B. Gillam’s McKinley Capital Management, and Jim Simons’ Renaissance Technologies.