At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

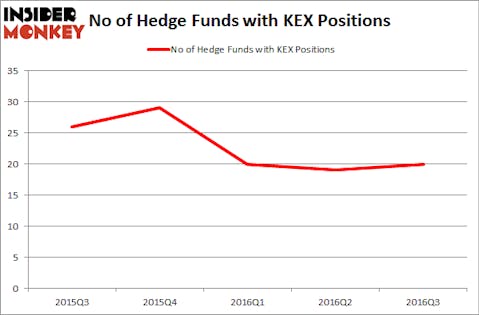

Kirby Corporation (NYSE:KEX) was in 20 hedge funds’ portfolios at the end of September. KEX shareholders have witnessed an increase in support from the world’s most successful money managers in recent months. There were 19 hedge funds in our database with KEX positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Seaboard Corporation (NYSEAMEX:SEB), AU Optronics Corp. (ADR) (NYSE:AUO), and Pitney Bowes Inc. (NYSE:PBI) to gather more data points.

Follow Kirby Corp (NYSE:KEX)

Follow Kirby Corp (NYSE:KEX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

crystal51/Shutterstock.com

What have hedge funds been doing with Kirby Corporation (NYSE:KEX)?

At the end of the third quarter, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a rise of 5% from the second quarter of 2016. By comparison, 29 hedge funds held shares or bullish call options in KEX heading into this year. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Chuck Royce’s Royce & Associates has the biggest position in Kirby Corporation (NYSE:KEX), worth close to $89.1 million. Sitting at the No. 2 spot is Diamond Hill Capital, led by Ric Dillon, holding a $78.2 million position. Remaining peers that are bullish comprise Robert Joseph Caruso’s Select Equity Group, Paul Marshall and Ian Wace’s Marshall Wace LLP and Robert Pohly’s Samlyn Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, some big names have jumped into Kirby Corporation (NYSE:KEX) headfirst. Samlyn Capital assembled the most valuable position in Kirby Corporation (NYSE:KEX). Samlyn Capital had $21.9 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $13.4 million position during the quarter. The other funds with new positions in the stock are Jacob Rothschild’s RIT Capital Partners, Phill Gross and Robert Atchinson’s Adage Capital Management, and Glenn Russell Dubin’s Highbridge Capital Management.

Let’s go over hedge fund activity in other stocks similar to Kirby Corporation (NYSE:KEX). These stocks are Seaboard Corporation (NYSEAMEX:SEB), AU Optronics Corp. (ADR) (NYSE:AUO), Pitney Bowes Inc. (NYSE:PBI), and Sunoco LP (NYSE:SUN). This group of stocks’ market values match KEX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SEB | 10 | 51591 | -2 |

| AUO | 10 | 56987 | -5 |

| PBI | 21 | 362364 | 2 |

| SUN | 12 | 47552 | 0 |

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $130 million. That figure was $344 million in KEX’s case. Pitney Bowes Inc. (NYSE:PBI) is the most popular stock in this table. On the other hand Seaboard Corporation (NYSEAMEX:SEB) is the least popular one with only 10 bullish hedge fund positions. Kirby Corporation (NYSE:KEX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PBI might be a better candidate to consider taking a long position in.

Disclosure: None