It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. The Standard and Poor’s 500 Index returned 7.6% over the 12-month period ending November 21, while more than 51% of the constituents of the index underperformed the benchmark. Hence, a random stock picking process will most likely lead to disappointment. At the same time, the 30 most favored mid-cap stocks by the best performing hedge funds monitored by Insider Monkey generated a return of 18% over the same time span. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Diana Shipping Inc. (NYSE:DSX).

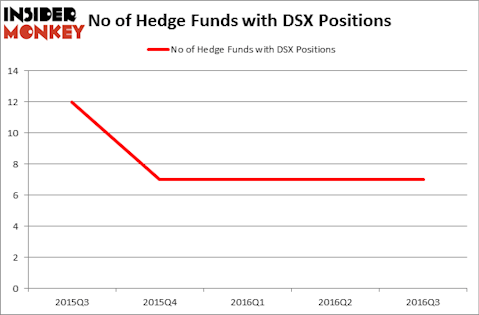

Diana Shipping Inc. (NYSE:DSX) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 7 hedge funds’ portfolios at the end of the third quarter of 2016. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as USA Technologies, Inc. (NASDAQ:USAT), Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK), and Equity BancShares Inc (NASDAQ:EQBK) to gather more data points.

Follow Diana Shipping Inc (NYSE:DSX)

Follow Diana Shipping Inc (NYSE:DSX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

weerasak saeku/Shutterstock.com

Hedge fund activity in Diana Shipping Inc. (NYSE:DSX)

At the end of the third quarter, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards DSX over the last 5 quarters. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Joel Ramin’s 12 West Capital Management has the number one position in Diana Shipping Inc. (NYSE:DSX), worth close to $11.6 million, corresponding to 1.7% of its total 13F portfolio. Coming in second is David Iben’s Kopernik Global Investors holding a $11.3 million position; the fund has 2.4% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism include Jim Simons’ Renaissance Technologies which is one of the largest hedge funds in the world, Chuck Royce’s Royce & Associates and Ken Griffin’s Citadel Investment Group. We should note that Kopernik Global Investors is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually cut their positions entirely. It’s worth mentioning that Geoffrey Raynor’s Q Investments (Specter Holdings) cut the biggest stake of the 700 funds tracked by Insider Monkey, totaling about $1.2 million in stock. Ken Griffin’s fund, Citadel Investment Group, also said goodbye to its call options, about $0 million worth.

Let’s now take a look at hedge fund activity in other stocks similar to Diana Shipping Inc. (NYSE:DSX). We will take a look at USA Technologies, Inc. (NASDAQ:USAT), Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK), Equity BancShares Inc (NASDAQ:EQBK), and MCBC Holdings Inc (NASDAQ:MCFT). This group of stocks’ market values are closest to DSX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| USAT | 8 | 5585 | 2 |

| OLBK | 3 | 11925 | -1 |

| EQBK | 6 | 33629 | 0 |

| MCFT | 15 | 99927 | 3 |

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $38 million. That figure was $28 million in DSX’s case. MCBC Holdings Inc (NASDAQ:MCFT) is the most popular stock in this table. On the other hand Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK) is the least popular one with only 3 bullish hedge fund positions. Diana Shipping Inc. (NYSE:DSX) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MCFT might be a better candidate to consider taking a long position in.

Disclosure: None