Yesterday, we discussed the jaw-dropping fall of Herbalife Ltd. (NYSE:HLF), which had lost over 12% due to allegations from Bill Ackman, manager of Pershing Square Capital, that the nutritional products company was a “pyramid scheme.” In our coverage, we also mentioned what Herbalife’s CEO, Michael Johnson, had to say about the claims, calling Ackman’s tactics “blatant market manipulation,” adding that “we want the SEC to take action.” Here’s the full recap of the drama.

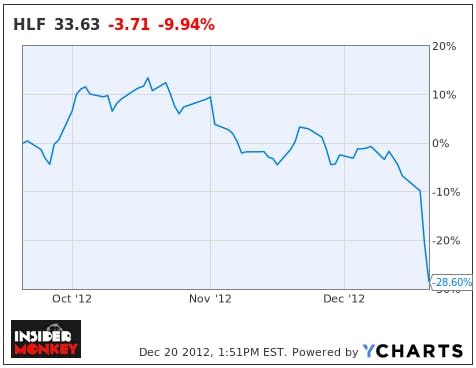

Here’s a look at Herbalife’s movement, which as you can see, has been quite drastic over the past two days. Shares had already been on a bit of a downswing since mid-October, but it’s clear that investors are fearful of these latest developments.

In Michael Johnson’s interview with CNBC yesterday, the Herbalife CEO mentioned that “an extraordinary number of puts on our stock were due to expire this Friday [tomorrow],” and suggested that “Mr. Ackman suddenly announces he will make a presentation on Herbalife on Thursday, the day before the puts expire.” It’s pretty easy to see where Johnson was going with this, so what did Ackman have to say in his short thesis today at the Sohn Conference?

Well, to the surprise of most permabears, Ackman didn’t offer up any groundbreaking revelations, but did mention that he was not an owner of any put options on Herbalife, according to Barron’s. So, it appears that Ackman’s short position isn’t as nefarious as most were led to believe yesterday, only that he sees fundamental flaws with Herbalife’s business model.

There are four main pillars that include…

They are as follows (via Barron’s): (1) questions Herbalife’s R&D practices, (2) mentioning that it “pays PhDs to lend them credibility,” (3) the assertion that around 90% of “compensation” is from “rewards,” calling that percentage evidence of a “pyramid scheme,” and (4) the evidence of “pop and drop” trends in various countries.

At the conclusion of his presentation, Ackman discusses Michael Johnson’s own insider transactions, adding that “[w]e welcome the SEC looking at our books.”

A quick look at the insider transactions of the Herbalife CEO show that he has performed no insider buys in the past year, while initiating a bevy of selling activity. Now, there are many reasons for insiders to sell a company, and it’s likely that this is profit-taking, but the records are publicly filed with the SEC. Take a look on our database for yourself, and check out some other coverage of Herbalife below:

Here’s What Herbalife’s CEO Had to Say About Ackman…It Wasn’t Pretty

David Einhorn Asked Herbalife Execs Some Interesting Questions in its Earnings Call