Ability to sign new long-term contracts

Helmerich & Payne, Inc. (NYSE:HP) declared impressive results for the second quarter of 2013, where it posted revenue of $838.3 million, up 8.9% year over year and ahead of the consensus estimate of $823 million. The earnings per share reported was $1.39, up 20.3% from the year ago period. These profits were led by better drilling activities around the quarter and innovation in the technological applications.

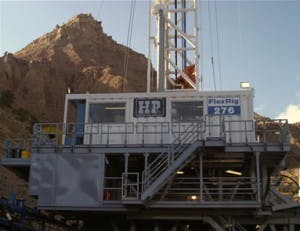

Helmerich & Payne, Inc. (NYSE:HP) has a proven track record of signing long-term contracts on its AC drive FlexRigs. It recently announced two agreements with an exploration and production company in the U.S. to build and operate two additional FlexRigs. It also signed an agreement to build a 3,000 horsepower AC drive rig, which is scheduled to begin operation in mid-2014 in Columbia.

These three rigs have multi-year contracts and will increase earnings per share to $5.55 per share in the current fiscal year. The higher earnings expectations are also estimated by looking at the increasing demand of the rigs in the dry gas basins. Dry gas basins are those basins which produce methane gas only.

Helmerich & Payne, Inc. (NYSE:HP) is currently producing two rigs per month to meet the new contract commitments, as it expects the demand of rigs is likely to increase later this year. Although it has 21 high-end AC drive FlexRigs currently idle, it’s anticipating that these rigs will be occupied as the demand rises.

Fleet renewal strategy to stay competitive

Noble Corporation (NYSE:NE) reported first-quarter 2013 earnings of $150 million compared to $128 million in the fourth quarter of 2012. It also witnessed a rise in revenue in the quarter, which was $971 million in comparison to $966 million in the fourth quarter of 2012. These results were mainly driven by the improved fleet utilization of the company, which increased to 86% in the first quarter of 2013 from 83% in the fourth quarter last year. Also, its day rates increased to $174,600 from $174,100 quarter over quarter.

The company is currently working on its fleet renewal strategy, which includes production of new drilling units and upgrading older drilling units. It entered into two contracts of three years each with Plains Exploration & Production for its two new ultra deepwater drill ships, the Noble Sam Croft and the Noble Corporation (NYSE:NE) Tom Madden. Both of them are under construction at the Hyundai Heavy Industries shipyard in Ulsan,South Korea, and will operate in the U.S.Gulf of Mexico region.

The deliveries of these drill ships are scheduled for the second quarter of 2014 and the second half of 2014, respectively. Each drill ship will generate revenue of about $693 million over the three year contract. Additionally, it has to deliver 11 rigs over the next two years under contracts signed in the past. This will boost the company’s cash flow over a longer period as the industry expects 50-70 new rig opportunities in the next seven years.

In its fleet renewal strategy, Noble Corporation (NYSE:NE) is working on reducing the unplanned downtime, which is the main concern of lower revenue generation. The company has already reduced it to 5% in the first quarter from 7% in the fourth quarter of 2012. It is further planning to reduce it to 4%-4.5% in 2013. I believe this will increase Noble Corporation (NYSE:NE)’s revenue and overall profit this year.

Higher than expected per day price of rigs will fetch increased revenue

Diamond Offshore Drilling Inc (NYSE:DO) recently posted first-quarter earnings for this fiscal year, in which it earned net income of $176 million. The company is on the growth path as it has bagged many contracts for its offshore well drillings.

Diamond Offshore Drilling Inc (NYSE:DO)’s recent orders have beaten the industry’s price expectations. It received two well drilling orders for The Ocean Saratoga, its mid-water semisubmersibles, in Nicaragua, at $323,000 per day versus the industry estimate of $260,000 per day. The company will start working on this in mid-November 2013. It also received well drilling contracts for its semisubmersible rig, The Ocean Victory, and jack-up, The Ocean King, in the Gulf of Mexico.

The Ocean Victory was signed at $480,000 per day versus the industry estimate of $425,000 per day, while The Ocean King was signed at $115,000 per day versus the industry estimate of $85,000 per day. These contracts are estimated to boost cash flow and will also reduce the downtime of its rigs. Diamond Offshore Drilling Inc (NYSE:DO) is currently facing downtime issues and its first-quarter downtime was 157 days versus 130 days in the fourth quarter of 2012.

Talking about the dividend, Diamond Offshore Drilling Inc (NYSE:DO) has followed a policy of paying special quarterly dividends to its shareholders in the past. In the first quarter, it declared special dividend of $0.75 per share, along with its regular quarterly dividend of $0.125 per share.

New contracts, new equipment, higher profit

With the increasing demand and efficiency, these companies are signing new exploration contracts to gain better share in the market. Diamond Offshore Drilling Inc (NYSE:DO) will benefit from better than expected prices for its rigs and new orders will also solve its downtime issues. Helmerich & Payne, Inc. (NYSE:HP) will benefit from the increased capacity of its AC drive rigs, which will help it generate better revenue. Noble Corporation (NYSE:NE)’s ongoing construction of two drill ships will provide an upside to revenue once deliveries are made.

Overall, I recommend buying these three stocks for the long-term.

The article 3 Oil Companies You Should Buy This Year originally appeared on Fool.com and is written by Madhu Dube.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.