The SEC requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings discloses the funds’ positions on September 30. We at Insider Monkey have compiled an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Veeva Systems Inc (NYSE:VEEV) based on those filings.

Is Veeva Systems Inc (NYSE:VEEV) a good investment today? Money managers are taking a bullish view. The number of bullish hedge fund bets went up by 2 recently. At the end of this article we will also compare VEEV to other stocks including Erie Indemnity Company (NASDAQ:ERIE), Blue Buffalo Pet Products Inc (NASDAQ:BUFF), and Donaldson Company, Inc. (NYSE:DCI) to get a better sense of its popularity.

Follow Veeva Systems Inc (NYSE:VEEV)

Follow Veeva Systems Inc (NYSE:VEEV)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

What does the smart money think about Veeva Systems Inc (NYSE:VEEV)?

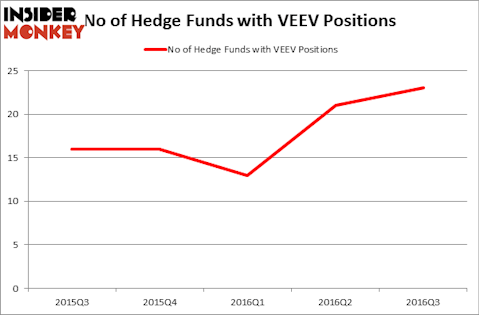

Heading into the fourth quarter of 2016, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 10% rise from the previous quarter, after a 63% rise in Q2. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Jim Simons’ Renaissance Technologies has the most valuable position in Veeva Systems Inc (NYSE:VEEV), worth close to $87.8 million. The second largest stake is held by Ryan Frick and Oliver Evans of Dorsal Capital Management, with a $51.6 million position; the fund has 3.2% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish comprise John Overdeck and David Siegel’s Two Sigma Advisors, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Matthew Iorio’s White Elm Capital.