Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

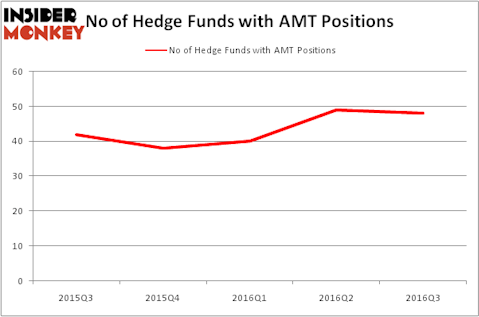

American Tower Corp (NYSE:AMT) investors should be aware of a decrease in support from the world’s most elite money managers recently. AMT was in 48 hedge funds’ portfolios at the end of September. There were 49 hedge funds in our database with AMT holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as UBS AG (USA) (NYSE:UBS), Dominion Resources, Inc. (NYSE:D), Adobe Systems Incorporated (NASDAQ:ADBE), and Express Scripts Holding Company (NASDAQ:ESRX) to gather more data points.

Follow American Tower Corp (NYSE:AMT)

Follow American Tower Corp (NYSE:AMT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: scandinavianstock / 123RF Stock Photo

With all of this in mind, let’s take a look at the recent action surrounding American Tower Corp (NYSE:AMT).

What have hedge funds been doing with American Tower Corp (NYSE:AMT)?

At the end of the third quarter, a total of 48 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -2% from the previous quarter. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Akre Capital Management, managed by Charles Akre, holds the most valuable position in American Tower Corp (NYSE:AMT). Akre Capital Management has a $714.1 million position in the stock, comprising 13.7% of its 13F portfolio. Sitting at the No. 2 spot is Highfields Capital Management, managed by Jonathon Jacobson, which holds a $379.9 million position; 3.6% of its 13F portfolio is allocated to the stock. Other members of the smart money with similar optimism include Philippe Laffont’s Coatue Management, Panayotis Takis Sparaggis’s Alkeon Capital Management and William von Mueffling’s Cantillon Capital Management.