Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

Dynegy Inc. (NYSE:DYN) has experienced a decrease in support from the world’s most elite money managers lately. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as IMAX Corporation (USA) (NYSE:IMAX), NGL Energy Partners LP (NYSE:NGL), and LPL Financial Holdings Inc (NASDAQ:LPLA) to gather more data points.

Follow Dynegy Inc. (NASDAQ:DYN)

Follow Dynegy Inc. (NASDAQ:DYN)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

chungking/Shutterstock.com

Now, we’re going to analyze the latest action surrounding Dynegy Inc. (NYSE:DYN).

What does the smart money think about Dynegy Inc. (NYSE:DYN)?

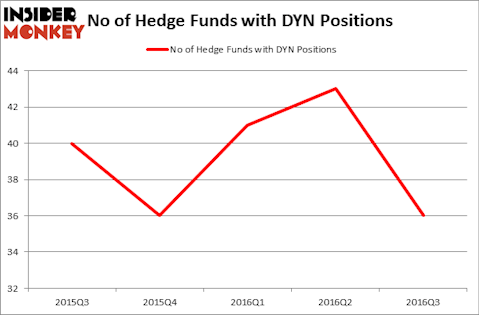

At the end of the third quarter, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -16% from the second quarter of 2016. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Viking Global, managed by Andreas Halvorsen, holds the biggest position in Dynegy Inc. (NYSE:DYN). Viking Global has a $138.2 million position in the stock, comprising 0.6% of its 13F portfolio. Coming in second is Oaktree Capital Management, led by Howard Marks, holding a $104.4 million position; the fund has 1.4% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism consist of Marc Lasry’s Avenue Capital, Clint Carlson’s Carlson Capital and Glenn Russell Dubin’s Highbridge Capital Management.

Because Dynegy Inc. (NYSE:DYN) has faced falling interest from hedge fund managers, logic holds that there exists a select few money managers who were dropping their positions entirely last quarter. Interestingly, Zach Schreiber’s Point State Capital cut the biggest investment of the “upper crust” of funds watched by Insider Monkey, valued at close to $61.3 million in stock. Robert Pitts’s fund, Steadfast Capital Management, also said goodbye to its stock, about $55.5 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest fell by 7 funds last quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Dynegy Inc. (NYSE:DYN) but similarly valued. These stocks are IMAX Corporation (USA) (NYSE:IMAX), NGL Energy Partners LP (NYSE:NGL), LPL Financial Holdings Inc (NASDAQ:LPLA), and Masonite International Corp (NYSE:DOOR). This group of stocks’ market valuations are closest to DYN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IMAX | 14 | 105884 | 1 |

| NGL | 6 | 14335 | 1 |

| LPLA | 12 | 964791 | -1 |

| DOOR | 21 | 339628 | -6 |

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $356 million. That figure was $760 million in DYN’s case. Masonite International Corp (NYSE:DOOR) is the most popular stock in this table. On the other hand NGL Energy Partners LP (NYSE:NGL) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Dynegy Inc. (NYSE:DYN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.