The market has been volatile due to elections and the potential of another Federal Reserve rate increase. Small cap stocks have been on a tear, as the Russell 2000 ETF (IWM) has outperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of June. SEC filings and hedge fund investor letters indicate that the smart money seems to be getting back in stocks, and the funds’ movements is one of the reasons why small-cap stocks are red hot. In this article, we analyze what the smart money thinks of Servicemaster Global Holdings Inc (NYSE:SERV) and find out how it is affected by hedge funds’ moves.

Servicemaster Global Holdings Inc (NYSE:SERV) shareholders have witnessed an increase in enthusiasm from smart money lately. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Copart, Inc. (NASDAQ:CPRT), Assurant, Inc. (NYSE:AIZ), and JetBlue Airways Corporation (NASDAQ:JBLU) to gather more data points.

Follow Terminix Global Holdings Inc (NYSE:TMX)

Follow Terminix Global Holdings Inc (NYSE:TMX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: andreypopov / 123RF Stock Photo

With all of this in mind, we’re going to review the latest action regarding Servicemaster Global Holdings Inc (NYSE:SERV).

How are hedge funds trading Servicemaster Global Holdings Inc (NYSE:SERV)?

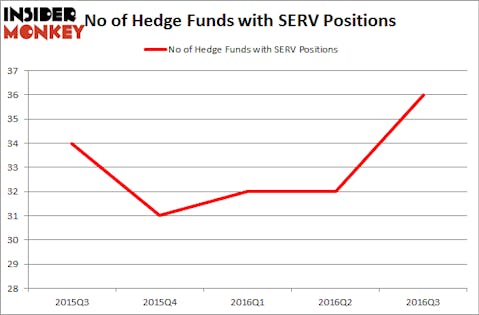

At Q3’s end, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, an increase of 13% from one quarter earlier. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Jonathan Auerbach’s Hound Partners has the number one position in Servicemaster Global Holdings Inc (NYSE:SERV), worth close to $271.9 million, amounting to 7.3% of its total 13F portfolio. On Hound Partners’s heels is William von Mueffling of Cantillon Capital Management, with a $220.7 million position; the fund has 3.1% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism consist of Matt Sirovich and Jeremy Mindich’s Scopia Capital, Scott McLellan’s Marble Arch Investments and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.