At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

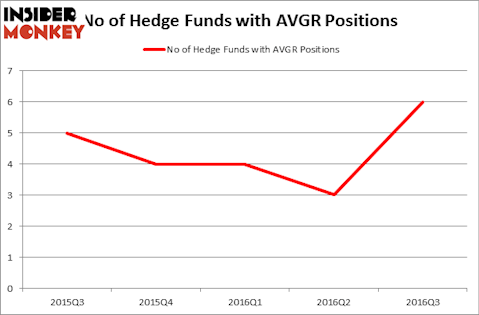

Avinger Inc (NASDAQ:AVGR) was in 6 hedge funds’ portfolios at the end of the third quarter of 2016. AVGR has experienced an increase in hedge fund interest recently. There were 3 hedge funds in our database with AVGR positions at the end of the previous quarter. At the end of this article we will also compare AVGR to other stocks including Petroquest Energy Inc (NYSE:PQ), BSQUARE Corporation (NASDAQ:BSQR), and Juniper Pharmaceuticals Inc (NASDAQ:JNP) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Now, we’re going to view the latest action encompassing Avinger Inc (NASDAQ:AVGR).

How are hedge funds trading Avinger Inc (NASDAQ:AVGR)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a jump of 100% from the second quarter of 2016. By comparison, 4 hedge funds held shares or bullish call options in AVGR heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chuck Royce’s Royce & Associates holds the number one position in Avinger Inc (NASDAQ:AVGR). According to regulatory filings, the fund has a $3.3 million position in the stock. Sitting at the No. 2 spot is Efrem Kamen’s Pura Vida Investments which holds a $2.7 million position. Remaining professional money managers with similar optimism consist of Anand Parekh’s Alyeska Investment Group, and Nathan Fischel’s DAFNA Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industrywide interest jumped, specific money managers were breaking ground themselves. Pura Vida Investments established the largest position in Avinger Inc (NASDAQ:AVGR. Anand Parekh’s Alyeska Investment Group also initiated a $1.8 million position during the quarter. The other funds with brand new AVGR positions are Pura Vida Investments, Nathan Fischel’s DAFNA Capital Management, and Millennium Management which is one of the 10 largest hedge funds in the world.

Let’s now take a look at hedge fund activity in other stocks similar to Avinger Inc (NASDAQ:AVGR). These stocks are Petroquest Energy Inc (NYSE:PQ), BSQUARE Corporation (NASDAQ:BSQR), Juniper Pharmaceuticals Inc (NASDAQ:JNP), and Rocky Mountain Chocolate Factory, Inc. (NASDAQ:RMCF). This group of stocks’ market valuations are closest to AVGR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PQ | 4 | 3272 | 2 |

| BSQR | 3 | 5138 | -1 |

| JNP | 3 | 1756 | -1 |

| RMCF | 4 | 5408 | 4 |

As you can see these stocks had an average of 3 hedge funds with bullish positions and the average amount invested in these stocks was $4 million. That figure was $9 million in AVGR’s case. Petroquest Energy Inc (NYSE:PQ) is the most popular stock in this table. On the other hand BSQUARE Corporation (NASDAQ:BSQR) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Avinger Inc (NASDAQ:AVGR) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None