Out of thousands of stocks that are currently traded on the market, it is difficult to determine those that can really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of over 700 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Dover Corp (NYSE:DOV) .

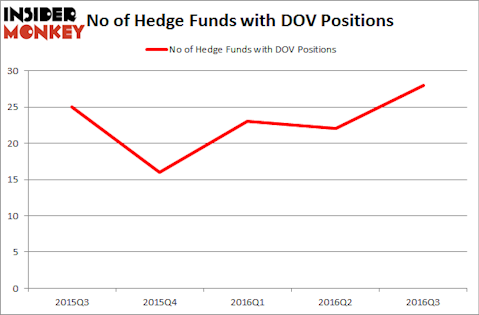

Is Dover Corp (NYSE:DOV) a good stock to buy now? The best stock pickers are genuinely in an optimistic mood. The number of bullish hedge fund bets that are revealed through the 13F filings increased by 6 in recent months. DOVwas in 28 hedge funds’ portfolios at the end of the third quarter of 2016. There were 22 hedge funds in our database with DOV holdings at the end of the previous quarter. At the end of this article we will also compare DOV to other stocks including Macy’s, Inc. (NYSE:M), Oneok Partners LP (NYSE:OKS), and Harris Corporation (NYSE:HRS) to get a better sense of its popularity.

Follow Dover Corp (NYSE:DOV)

Follow Dover Corp (NYSE:DOV)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

With all of this in mind, we’re going to take a look at the latest action surrounding Dover Corp (NYSE:DOV).

How have hedgies been trading Dover Corp (NYSE:DOV)?

Heading into the fourth quarter of 2016, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, a jump of 27% from the second quarter of 2016. On the other hand, there were a total of 16 hedge funds with a bullish position in DOV at the beginning of this year. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Richard S. Pzena’s Pzena Investment Management has the biggest position in Dover Corp (NYSE:DOV), worth close to $426.7 million, corresponding to 2.6% of its total 13F portfolio. The second most bullish fund manager is Citadel Investment Group, led by Ken Griffin, which holds a $68.8 million position; 0.1% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions contain Jeffrey Gates’s Gates Capital Management, Phill Gross and Robert Atchinson’s Adage Capital Management and Israel Englander’s Millennium Management. We should note that Gates Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Consequently, key money managers have jumped into Dover Corp (NYSE:DOV) headfirst. Lodge Hill Capital, led by Clint Murray, established the largest position in the stock. According to regulatory filings, the fund had $34.2 million invested in the company at the end of the quarter. Andreas Halvorsen’s Viking Global also made a $3.9 million investment in the stock during the quarter. The following funds were also among the new DOV investors: Solomon Kumin’s Folger Hill Asset Management, Steve Cohen’s Point72 Asset Management, and Ken Griffin’s Citadel Investment Group.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Dover Corp (NYSE:DOV) but similarly valued. We will take a look at Macy’s, Inc. (NYSE:M), Oneok Partners LP (NYSE:OKS), Harris Corporation (NYSE:HRS), and International Flavors & Fragrances Inc (NYSE:IFF). This group of stocks’ market caps match DOV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| M | 63 | 1336444 | 6 |

| OKS | 9 | 33692 | 2 |

| HRS | 22 | 476297 | 1 |

| IFF | 16 | 269994 | -4 |

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $529 million. That figure was $828 million in DOV’s case. Macy’s, Inc. (NYSE:M) is the most popular stock in this table. On the other hand Oneok Partners LP (NYSE:OKS) is the least popular one with only 9 bullish hedge fund positions. Dover Corp (NYSE:DOV) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard M might be a better candidate to consider taking a long position in.

Disclosure: none.