We started seeing tectonic shifts in the market during the third quarter. Small-cap stocks underperformed the large-cap stocks by more than 10 percentage points between the end of June 2015 and the end of June 2016. A mean reversion in trends bumped small-cap stocks’ return to almost 9% in Q3, outperforming their large-cap peers by 5 percentage points. The momentum in small-cap space hasn’t subsided during this quarter either. Small-cap stocks beat large-cap stocks by another 5 percentage points during the first 7 weeks of this quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were boosting their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Life Storage Inc (NYSE:LSI).

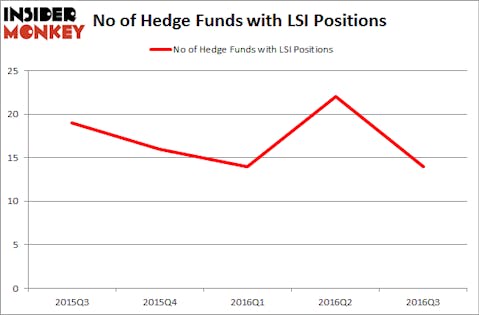

Life Storage Inc (NYSE:LSI) shareholders have witnessed a decrease in enthusiasm from smart money of late. 14 hedge funds that we track were long the stock on September 30. There were 22 hedge funds in our database with LSI positions at the end of the second quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Corrections Corp Of America (NYSE:CXW), Brunswick Corporation (NYSE:BC), and Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL) to gather more data points.

Follow Life Storage Inc. (NYSE:LSI)

Follow Life Storage Inc. (NYSE:LSI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

designer491/Shutterstock.com

How are hedge funds trading Life Storage Inc (NYSE:LSI)?

Heading into the fourth quarter of 2016, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 36% tumble from the previous quarter, giving back all of the gains made during the second quarter. The graph below displays the number of hedge funds with bullish position in LSI over the last 5 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, founded by Jim Simons, holds the number one position in Life Storage Inc (NYSE:LSI). Renaissance Technologies has an $85.2 million position in the stock. Sitting at the No. 2 spot is Fisher Asset Management, led by Ken Fisher, holding an $80 million position. Remaining members of the smart money that hold long positions consist of Anand Parekh’s Alyeska Investment Group, Israel Englander’s Millennium Management, and Greg Poole’s Echo Street Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually got rid of their positions entirely. Interestingly, Stuart J. Zimmer’s Zimmer Partners got rid of the biggest position of the 700 funds followed by Insider Monkey, valued at close to $33 million in stock. Peter Rathjens, Bruce Clarke and John Campbell’s fund, Arrowstreet Capital, also cut its stock, about $19.7 million worth.

Let’s now review hedge fund activity in other stocks similar to Life Storage Inc (NYSE:LSI). We will take a look at Corrections Corp Of America (NYSE:CXW), Brunswick Corporation (NYSE:BC), Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL), and Olin Corporation (NYSE:OLN). This group of stocks’ market caps match LSI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CXW | 27 | 186592 | 12 |

| BC | 30 | 500919 | -1 |

| CBRL | 22 | 127400 | 7 |

| OLN | 18 | 989434 | -10 |

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $451 million. That figure was $325 million in LSI’s case. Brunswick Corporation (NYSE:BC) is the most popular stock in this table. On the other hand Olin Corporation (NYSE:OLN) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Life Storage Inc (NYSE:LSI) is even less popular than OLN. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock and why they rapidly gave up on it in Q3 after being so bullish in Q2.

Disclosure: None