At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Gamco Investors Inc (NYSE:GBL) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 9 hedge funds’ portfolios at the end of the third quarter of 2016. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Crossamerica Partners LP (NYSE:CAPL), Cardinal Financial Corporation (NASDAQ:CFNL), and TriMas Corp (NASDAQ:TRS) to gather more data points.

Follow Gamco Investors Inc. Et Al (NYSE:GBL)

Follow Gamco Investors Inc. Et Al (NYSE:GBL)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

How are hedge funds trading Gamco Investors Inc (NYSE:GBL)?

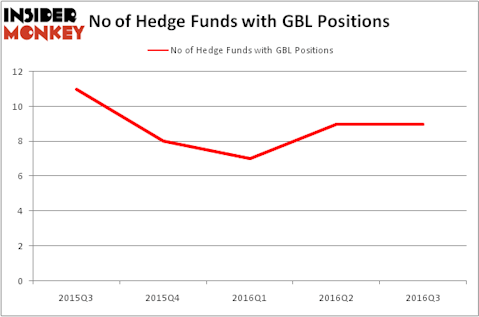

At Q3’s end, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GBL over the last 5 quarters. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Royce & Associates, led by Chuck Royce, holds the number one position in Gamco Investors Inc (NYSE:GBL). Royce & Associates has a $7.8 million position in the stock. The second most bullish fund manager is Murray Stahl of Horizon Asset Management, with a $1.4 million position. Other members of the smart money that are bullish include Millennium Management, one of the 10 largest hedge funds in the world, Jim Simons’ Renaissance Technologies and Cliff Asness’ AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Highbridge Capital Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Citadel Investment Group).

Let’s now take a look at hedge fund activity in other stocks similar to Gamco Investors Inc (NYSE:GBL). We will take a look at Crossamerica Partners LP (NYSE:CAPL), Cardinal Financial Corporation (NASDAQ:CFNL), TriMas Corp (NASDAQ:TRS), and Transocean Partners LLC (NYSE:RIGP). This group of stocks’ market values are closest to GBL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAPL | 5 | 26687 | 0 |

| CFNL | 11 | 70084 | 2 |

| TRS | 17 | 73263 | 1 |

| RIGP | 8 | 68835 | 2 |

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $60 million. That figure was $14 million in GBL’s case. TriMas Corp (NASDAQ:TRS) is the most popular stock in this table. On the other hand Crossamerica Partners LP (NYSE:CAPL) is the least popular one with only 5 bullish hedge fund positions. Gamco Investors Inc (NYSE:GBL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TRS might be a better candidate to consider taking a long position in.

Suggested Articles:

Countries With The Lowest Cost Of Living

States With The Lowest Substance Abuse Rates

Largest Farming States In the US

Disclosure: None