Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Is DSW Inc. (NYSE:DSW) a great investment now? Investors who are in the know are turning bullish. The number of long hedge fund positions moved up by 6 in recent months. At the end of this article we will also compare DSW to other stocks including Innocoll AG (NASDAQ:INNL), Insulet Corporation (NASDAQ:PODD), and Luxoft Holding Inc (NYSE:LXFT) to get a better sense of its popularity.

Follow Designer Brands Inc. (NYSE:DBI)

Follow Designer Brands Inc. (NYSE:DBI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Maryna Pleshkun/Shutterstock.com

How have hedgies been trading DSW Inc. (NYSE:DSW)?

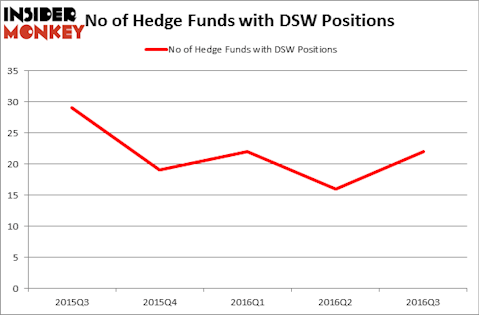

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 38% jump from the previous quarter, though that followed a three quarter stretch of falling ownership of the stock. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Greenlight Capital, managed by David Einhorn, holds the number one position in DSW Inc. (NYSE:DSW). Greenlight Capital has a $73.2 million position in the stock, comprising 1.4% of its 13F portfolio. On Greenlight Capital’s heels is Royce & Associates, led by Chuck Royce, holding a $49.4 million position. Remaining members of the smart money that hold long positions encompass Phill Gross and Robert Atchinson’s Adage Capital Management, Gilchrist Berg’s Water Street Capital and Israel Englander’s Millennium Management.