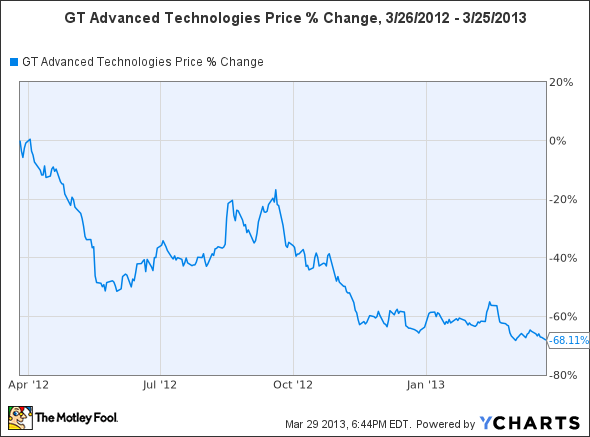

Shareholders of GT Advanced Technologies Inc. (NASDAQ:GTAT) probably felt like they were in for more of the same old price action last week — namely, downward. Sure enough, the stock steadily marched lower throughout Monday’s session before finally closing down nearly 3%.

Even so, that paled in comparison to its harrowing plunge over the previous year:

Then, in keeping with the market’s unpredictible nature, things quickly took a turn for the better as shares of GT Advanced Technologies Inc. (NASDAQ:GTAT) rose 10% last Tuesday following several media reports highlighting a recent MIT Technology Review article, which pitched the company’s sapphire technology as a promising up-and-coming alternative to Corning Incorporated (NYSE:GLW)‘s wildly popular Gorilla Glass.

Even better, GTAT jumped another 10% two days later after it announced a memorandum of understanding with Powertec Energy, through which Powertec stated its intention to purchase polysilicon technology and equipment from GTAT in the second half of 2014.

But that begs the question: Was GTAT’s 24% rise over the course of just three trading days justified? After all, it does appear to be the result of positive developments which haven’t even come to fruition yet.

With regard to sapphire, it’s also important to remember Corning Incorporated (NYSE:GLW) has been in business for more than 160 years, so it surely won’t be an easy task for GTAT to break the stranglehold its larger competitor has on the electronics market through its Gorilla Glass.

On the solar side, should investors really be this excited over polysilicon equipment orders which won’t show up for nearly two more years?

In a word: Yes.

Is sapphire a phone’s best friend?

First, as I mentioned just a few weeks ago, more than half of GT Advanced Technologies Inc. (NASDAQ:GTAT)’s current $1.25 billion backlog at the end of 2012 came from its sapphire segment, with two-thirds of it driven by established LED and industrial solutions and the remainder coming from potential low-volume smartphone and camera lens adoption. Additionally, as fellow Fool Evan Niu pointed out last week, Apple Inc. (NASDAQ:AAPL)‘s iPhone 5 already incorporates a sapphire camera lens cover on the back, and rumors continue to circulate that Google Inc. (NASDAQ:GOOG)‘s upcoming Motorola “X Phone” might use sapphire in some capacity.

Besides, given the fact GTAT’s total market capitalization is still less than $400 million — even after last week’s pop — it shouldn’t take much new sapphire business to move its profit needle compared to the huge design wins needed by multibillion dollar giants like Corning Incorporated (NYSE:GLW). With that in mind, however, GTAT also needs to keep other small sapphire suppliers like Rubicon Technology, Inc. (NASDAQ:RBCN) in its sights; its safe to say Rubicon has just as much to gain as GTAT in this market, so we can be sure it will be gunning for much of the same business.

It’s all about 2014

The polysilicon agreement with Powertec also lends credence to the repeated assertions from GT Advanced Technologies Inc. (NASDAQ:GTAT) management that they believe market demand will finally begin to pick up in 2014, once again driving increased adoption of their furnace technologies. As I noted last month, that’s also why GTAT told us in its most recent earnings conference call that it was “delaying any significant expenditure related to market introduction of [its] HiCz product until 2014.”

In the end, last week’s events not only served to call attention to the huge potential of GT Advanced Technologies Inc. (NASDAQ:GTAT)’s products, but also went a long way toward building some much-needed rapport with its shareholders. After what solar industry investors have endured recently, the importance of regaining that confidence can’t be overstated.

The article Can This Solar Play Return to Its Former Glory? originally appeared on Fool.com.

Fool contributor Steve Symington has no position in any stocks mentioned. The Motley Fool recommends Apple, Corning, and Google. The Motley Fool owns shares of Apple, Corning, and Google.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.