Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

In this article, we’ll take a closer look at Greenlight Capital Re, Ltd. (NASDAQ:GLRE), which didn’t see any changes in hedge fund interest between July and September. This is usually a negative indicator. At the end of this article we will also compare GLRE to other stocks including Sandstorm Gold Ltd. (NYSE:SAND), Encore Wire Corporation (NASDAQ:WIRE), and Constellium NV (NYSE:CSTM) to get a better sense of its popularity.

Follow Greenlight Capital Re Ltd. (NASDAQ:GLRE)

Follow Greenlight Capital Re Ltd. (NASDAQ:GLRE)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

nito/Shutterstock.com

Keeping this in mind, let’s go over the new action encompassing Greenlight Capital Re, Ltd. (NASDAQ:GLRE).

Hedge fund activity in Greenlight Capital Re, Ltd. (NASDAQ:GLRE)

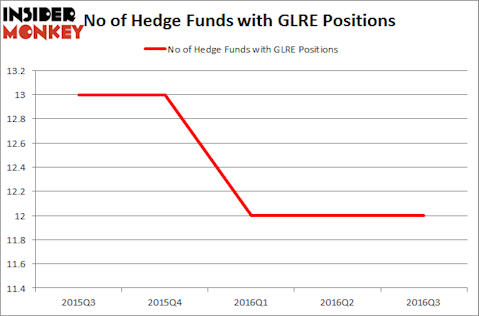

Heading into the fourth quarter of 2016, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from the previous quarter. On the other hand, there were a total of 13 hedge funds with a bullish position in GLRE at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Seth Rosen’s Nitorum Capital has the number one position in Greenlight Capital Re, Ltd. (NASDAQ:GLRE), worth close to $12 million, corresponding to 4.8% of its total 13F portfolio. The second most bullish fund manager is Weatherbie Capital, led by Matthew A. Weatherbie, which holds a $11.4 million position; 1.4% of its 13F portfolio is allocated to the company. Some other members of the smart money that hold long positions contain Ric Dillon’s Diamond Hill Capital, Murray Stahl’s Horizon Asset Management, and Gregg Moskowitz’s Interval Partners. We should note that Nitorum Capital is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.