In the hedge fund universe, 13F filing season is in full bloom, and while these positions are reported to the SEC with a 45-day delay, this actually improves investors’ ability to beat the market because, on average, fund managers are early into their investments. Our research has shown that hedge funds’ consensus stock picks beat the market handily, and

He’s a hedge fund kahuna that needs no introduction, so let’s take a look at George Soros and the rest of his investment team’s key moves from the fourth quarter.

Bullish on big banks

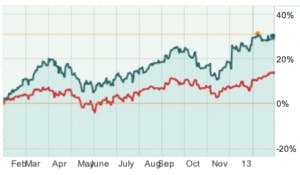

The global banking industry as a whole has returned more than 25% over the past year, and Soros’s fund, aptly named Soros Fund Management, was playing this fiddle in the fourth quarter.

After sitting in the No. 50 spot in Soros’s 13F portfolio at the end of the third quarter, Citigroup Inc. (NYSE:C) is now the hedgie’s top common stock holding. Soros also upped his stake in JPMorgan Chase & Co (NYSE:JPM) by more than 150% over this three-month period, while taking a new position in Morgan Stanley (NYSE:MS).

Combined, this trio represented an exposure of greater than $510 million at the end of last year, and shares of each banking stock have risen by double-digits in 2013 thus far. From a valuation standpoint, Citigroup is the most attractive of the bunch at a mere 0.7 times book, and its global focus gives it an added growth advantage. The bank has also seen multiple high-level insiders buying shares since last November—yet another bullish indicator to be aware of.

Doubling down on Apple Inc. (NASDAQ:AAPL)

Here’s where it gets really interesting. As the latest round of 13F filings have fluttered in, hedge funds have been all over

A dividend yield near 2.3% offers a solid payout, but with its overhyped treasure trove of cash, the company can make its shares more attractive to income-oriented investors. It appears that Apple Inc. (NASDAQ:AAPL)’s so-called “secret” hedge fund may be preparing for such a move.

Even if a dividend boost or a lengthened share buyback are off the table, Apple still offers better growth prospects than Google Inc (NASDAQ:GOOG), Microsoft Corporation (NASDAQ:MSFT) and most other large-cap tech companies out there.

The sell-side expects Cupertino to average earnings growth of 18%-19% a year over the next half-decade, and a PEG near 0.5 indicates Mr. Market isn’t anywhere close to accurately judging this potential.

Who’s the best of the rest aside from Apple Inc. (NASDAQ:AAPL) and the big banks?

Adecoagro going strong

We’ve already discussed Adecoagro SA (NYSE:AGRO) in our analysis of George Soros’s best small-cap stock picks (which may be the best way to “monkey” hedge funds), and it’s worth noting that the agricultural holding company is still a top five pick in his portfolio. High-value arable land is the key driving force behind this stock, and Adecoagro has plenty of it. The company owns more than three-dozen properties in Brazil, Uruguay and Argentina, where farmland prices have followed a favorable trend similar to price levels in the U.S.

Trading at parity with their book value, shares of Adecoagro are obviously cheap at the moment, which is a trait that most of Soros’s high-conviction investments share. It’s easy to understand why the billionaire hedge fund manager is so bullish.

Click here to learn more about Insider Monkey’s Hedge Fund Newsletter

Insider Monkey’s small-cap strategy returned 25.4% between September 2012 and January 2013 versus 7.4% for the S&P 500 index. Try it now by clicking the link above.

Disclosure: none