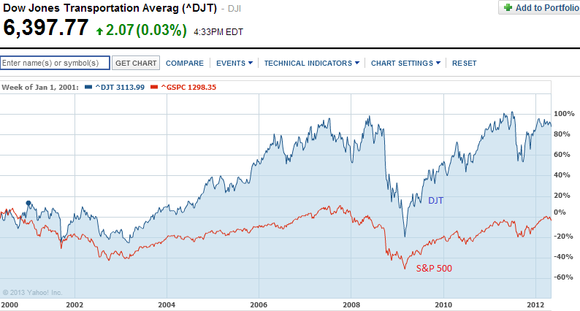

American transportation companies are showing strong signs of life. From the chart below, note how well Dow Transports performed in the last 12 years relative to the S&P 500.

One reason the Dow Jones Transportation Average has done so well is because of railroad companies. Of the six industries represented in the average, the rail industry performed best.

With the economy coming back on track, I believe that the railroad industry still has significant growth ahead of it. Here are five stocks that had incredible results, but more importantly, will continue to post incredible results.

Industry at a glance

| Industry | GWR | KSU | CP | UNP | CNI | |

|---|---|---|---|---|---|---|

| Revenue Q1′ 13 | $299M | $552.8M | $1.5B | $5B | $2.25B | |

| Cash & Cash Equivalents | $622M | $64M | $73M | $334M | $2B | $640M |

| Market Cap | $19.70B | $4.75B | $12.54B | $23.42B | $73.63B | $42.92B |

| P/E Ratio | 17.3 | 43.71 | 30.88 | 40.89 | 18.52 | 17.52 |

| EV/EBITDA | 9.13 | 18.94 | 15.66 | 14.59 | 9.4 | 10.74 |

| Operating Margin | 29.98% | 46.7% | 30.8% | 22.5% | 13.3% | 36.6% |

Room to grow

Genesee & Wyoming Inc (NYSE:GWR) is a short-line railroad holding company that owns an interest in 63 railroad companies in the U.S., Canada, Bolivia, Australia, Mexico, Belgium, and the Netherlands. For the first quarter of 2013, in its North American division it had an increase in total operating revenue of 80.9% due to increased traffic of 102.7%. Revenue growth is estimated at 23.5%, which is significant considering Genesee & Wyoming Inc (NYSE:GWR)’s operating margin.

In short, these numbers point to increased volume, financial stability, and profit growth. But there’s more.

Revenue this past quarter jumped 81% from Q1 2012. Last year Genesee & Wyoming Inc (NYSE:GWR) bought its main competitor, RailAmerica, a move that combined North America’s two largest short-line and regional rail operators. The rail holding company is now the largest player in its class.

The best performing stock of the rail industry is Kansas City Southern (NYSE:KSU), which was added to the S&P 500 on May 17, 2013.

The company is expected to boost sales by 48% through 2016, the fastest in the rail industry. This year Kansas City Southern (NYSE:KSU) will spend 21% of its revenue on CAPEX, $47 million on track infrastructure, $27 million on origin facilities, and $29 million on intermodal expansion.

In 2011 it entered into a joint development agreement with Savage Companies to build a unit train crude oil destination terminal in Port Arthur, Texas. The terminal improves its position relative to refineries in the area.

Finally, the company is one of few Class I railroad companies to own tracks both inside and outside of Mexico’s boundaries. Its Mexican operations help drive revenue as the Mexican economy grows at 5.5%, nearly double that of the United States.

Slow and steady

Canadian Pacific Railway Limited (USA) (NYSE:CP) operates railways in Canada and in the U.S. The company provides freight transportation services, logistics solutions, and supply chain management.

This year Canadian Pacific Railway Limited (USA) (NYSE:CP) will continue to focus on asset efficiency, safety, and productivity. Also, between $75 million and $100 million will be added to the railway’s $1.1 billion budget in an effort to bolster efficiency.