The auto industry is back!

Four years after the great recession vehicle sales are returning to normal levels. With reorganized operations, manufacturers are now more profitable than ever.

But the industry has a hidden source of profits.

Over the last decade, automakers and suppliers have managed to significantly reduce the cost of warranties on their vehicles. This has become a massive, little discussed source of shareholder returns.

Falling warranty costs

Over the past decade, automakers have been setting less money aside to cover future warranty claims.

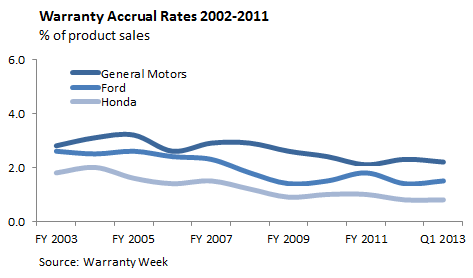

Warranty reserves are measured through the warranty accrual rate. This is typically expressed as a percentage of sales and may vary depending on a vehicle’s sale price, reliability, and repair costs.

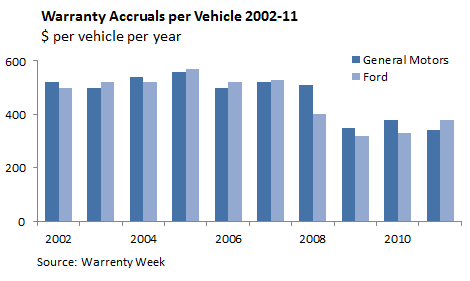

General Motors Company (NYSE:GM) and Ford Motor Company (NYSE:F) have both reduced their warranty accrual rate by 1.0% and 1.1% respectively over the past eight years. Since 2005, annual warranty costs per vehicle have fallen 40%.

Other manufacturers have benefited from this trend as well.

Honda Motor Co Ltd (ADR) (NYSE:HMC) has reduced its warranty accrual rate by 1.2% over the past 10 years. Honda Motor Co Ltd (ADR) (NYSE:HMC)’s annual warranty cost per vehicle, which is the best in the industry, hit a multi-decade low of $182 in 2012. That’s less than half the cost the company incurred in 2004.

However, some of these savings can be explained by changes in the company’s product mix. In 2012, automotive sales accounted for 78% of revenues with motorcycles and generators taking an increasing share.

Reasons

There are a couple of explanations for this trend.

Data: Better data allows manufacturers to spot and address patterns of failure before the need of a recall or warranty campaign. Better data also allows automakers to more effectively pass the blame and cost on to their suppliers.

Quality: Vehicles are more reliable than ever. New models break down less often and repairs are less costly. And there’s some data to back this up. According to a report by J.D. Power and Associates, problems reported by owners of three- year old vehicles dropped 5% in 2012 to the lowest levels since the company started collecting data in 1989.

Asia: Manufacturers are changing their product mix to smaller, lower priced vehicles with shorter warranties. This is especially noticeable in Asia. Since entering the market over a decade ago, Asia now accounts for 10% and 7.6% of General Motors Company (NYSE:GM)’ and Ford Motor Company (NYSE:F)’s revenues respectively.

Of course, accrual rates are only based on what automakers think warranty claims will be in the future. Actual claims could differ from significantly from estimates resulting in losses if manufactures don’t set aside enough funds.

However, a glance at the historical data shows automakers are pretty good at estimating future claims.

The takeaway

So what does all this mean for shareholders?

Margins in the automotive industry are tight. A one or two percent cost saving can translate into big gains on the bottom line.

Take General Motors Company (NYSE:GM) for example. A $180 decline in annual warranty expense per vehicle, multiplied by the nine million vehicles the company sold last year, represents a $1.6 billion cost savings. That equals 22% of General Motors Company (NYSE:GM)’ net income last year.