The rising trend in food price inflation has outpaced overall inflation during the past few years.

Company analysis

This post centers on scrutinizing the stocks in processed and packaging industry. I have picked up General Mills, Inc. (NYSE:GIS) based on its P/E undervaluation against the industry. For comparison purposes, I chose three of its peers, namely Kellogg Company (NYSE:K), Campbell Soup Company (NYSE:CPB), and Seneca Foods Corp (NASDAQ:SENEA).

Financial performance analysis

Source: Morningstar

General Mills, Inc. (NYSE:GIS) was able to outclass Kellogg Company (NYSE:K), Seneca Foods Corp (NASDAQ:SENEA), and Campbell Soup Company (NYSE:CPB) by registering higher positive revenue growth and net margin growth. The company aims to deliver low single digit annual growth in conjunction with high single digit growth in EPS. The growth was primarily driven by contributions from the Yoplait acquisition, volume gains in the international segment, and net price realization and sales mix.

The company was able to post net profit growth in spite of the high levels of input cost inflation. The company focuses on holistic margin management (HMM) program, which covers cost-savings initiatives, marketing spending efficiencies, and profitable sales mix strategies.

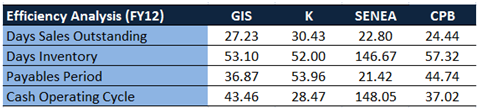

Cash operating cycle represents the efficacy with which a company manages its working capital. Kellogg has the shortest cash operating cycle, which places the company in a better position as its cash is locked up for a relatively smaller period of time, followed by Campbell. Cash operating cycle for General Mills, Inc. (NYSE:GIS) is higher at 43 days, which apparently exhibits that the entity takes more time to convert inventory into sales and then, collect payments from customers.

Nonetheless, analyzing the individual components reveals that Kellogg Company (NYSE:K)’s cash conversion is lower mainly due to its higher payable days, which could impair its reputation in the marketplace in the long run. The same reasons apply for Campbell Soup Company (NYSE:CPB) along with the higher inventory days.

Seneca Foods Corp (NASDAQ:SENEA)’s cash operating cycle is way above the other players operating in the industry, which shows that the company is not able to efficiently manage its working capital resources. The inventory days, in particular, is the area where the problem lies as Seneca has major issues in converting inventory into sales. This could be of particular concern in the food packaging industry.

On the face of it, Campbell and Kellogg seem to have reported extraordinary return on equity compared to General Mills, Inc. (NYSE:GIS) in fiscal 2012. Nonetheless, analyzing the components separately reveals the fact that the exuberantly high return on equity for both companies were mainly backed by the higher financial leverage employed by both of them. Such a high level of debt could be a cause of grave concern for the companies and is particularly not liked by investors as it increases their equity risk.

Lower asset turnover of General Mills, Inc. (NYSE:GIS) was also a partial contributor of its lower return on equity, compared to its rivals, as the company’s assets (12.97%) grew faster than its revenue (11.95%).

General Mills, Inc. (NYSE:GIS) posted terrific growth in its cash flow from operations, fundamentally driven by tax savings that arose from higher depreciation and amortization expense and income from restructuring, impairment, and other exit costs, which is expected to be a non-recurring item. Excluding this component, the year-on-year growth was 41.35%, which is still quite high compared to the company’s peers.

Seneca experienced a drastic fall in its operating cash flows, owing to the plunged net profit margin by 36.3% in FY12 compared to FY11.

In a risky interest rate setting, high yields from fixed income bonds tend to make dividend paying stocks less striking. General Mills is currently offering a dividend yield of 2.74%. In the midst of 10-year Treasury yields above 2.5% coupled with the moderate growth prospects of this company, it does not seem justified to choose the stock over a risk free investment.

Takeaway

If Treasury bond yields continue to rise and growth does not pick up, this could put the stock of General Mills, Inc. (NYSE:GIS) in danger. Under the current circumstances that prevail, I would recommend selling the shares of the company.

The article General Mills: Rising Treasury Yield Threatens Low Growth Companies originally appeared on Fool.com and is written by Awais Iqbal.

Awais Iqbal has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Awais is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.