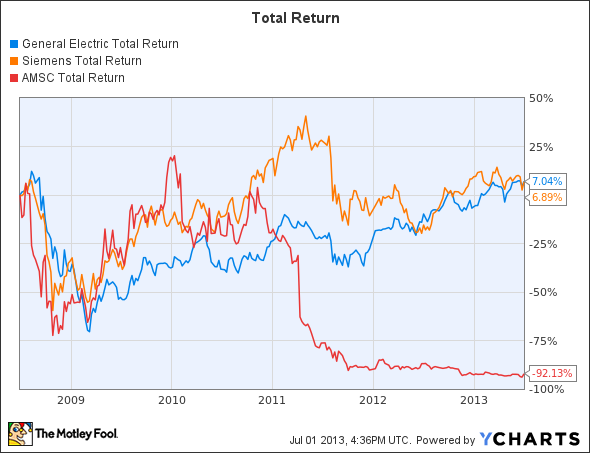

Wind energy may not sound very high-tech, but onshore wind turbines are expected to provide the majority of clean energy’s growth over the next couple years. Industry is slowly making wind energy a more reliable power source. While General Electric Company (NYSE:GE) is starting to package small scale energy storage systems with its wind turbines, it is also a stable way for investors to profit.

GE Total Return Price data by YCharts

In 2012, General Electric Company (NYSE:GE) and the Danish firm Vestas had an equal share of the wind turbine market, while Siemens AG (NYSE:SI) came in third. Based on the number of megawatts installed in 2012, GE is the only American firm in the top ten wind turbine manufacturers. It continues to roll out new turbines in addition to its latest battery storage system. Its 1.5 MW series is the most common turbine throughout the world. GE’s latest 1.6-100 and 1.7-100 systems improve its older designs by increasing the amount of swept area, thus providing wind farm operators with more energy from the same footprint.

A quick look at General Electric Company (NYSE:GE)’s earnings makes it obvious that wind power is a small amount of the firm’s earnings, and this is an advantage. GE uses its large size to invest for the long-term and ignore short-term market froth. Its power and water segment made $719 million in operating profit in Q1 2013, 14.8% of the firm’s total operating profit. Its complementary energy management segment makes General Electric Company (NYSE:GE) a good investment for the entire electricity grid.

GE’s profit margin of 9.7% and earnings before interest and taxes (EBIT) margin of 20% are healthy. Its 3.3% yield makes GE one of the few ways to invest in clean energy and receive stable cash flow.

The German Competitor

Siemens AG (NYSE:SI) is a strong European player in the wind industry, but it must work very hard to move outside of Europe. While euro woes are causing havoc in the EU, Siemens is looking to other European nations to even out its growth. By focusing on Russia and the Nordic countries, Siemens AG (NYSE:SI) will be able to make more profit in rubles and kroner.

To help stay competitive Siemens has developed the massive SWT-6.0-120 and SWT-6.0-154 for offshore wind farms. Still, offshore wind farms are very expensive and filled with challenges. It is telling that the International Energy Agency predicts that over the coming years, most of the growth in wind energy will come from onshore wind turbines.

Similar to GE, Siemens’ wind division only provides a portion of the firm’s profits. In Q2 2013, it generated €53 million in profit while its fossil fuel power generation division generated €431 million in profit. The company’s overall EBIT margin of 10.8% and profit margin of 5.7% are a step below General Electric Company (NYSE:GE)’s, as it is hard for Siemens AG (NYSE:SI) to completely avoid Europe’s struggles.