The five components of the z-score are listed below:

The z-score is then calculated from these values as follows:

If this number is above 2.99 then the company is considered safe. Between 1.81 and 2.99 is the “grey zone,” where the company is not in immediate danger of bankruptcy but may be heading in that direction. Anything below 1.81 means that the company is distressed and has a good chance of going bankrupt within a few years.

These weightings and limits are completely empirical, not based on anything fundamental – they’re simply what works. The model has been extremely accurate in predicting bankruptcies, with a success rate around 80%-90% according to this research. It’s not perfect, but it is a helpful gauge of financial stability.

I’ll calculate the Altman z-score for three different companies that have had bankruptcy rumors swirling around them for quite some time. These companies are GameStop Corp. (NYSE:GME), Research In Motion Ltd (NASDAQ:BBRY), and Nokia Corporation (ADR) (NYSE:NOK).

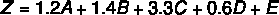

Gamestop

GameStop Corp. (NYSE:GME) sells new and used video game hardware, software, and accessories, and according to Morningstar holds an 80% share of the used video game market. In 2012 the company saw revenue and profitability decline, and in 2013 about 250 unprofitable or marginally profitable stores will be closed. Any time there are store closings people start to speculate on the fate of the company, and many seem to think that GameStop Corp. (NYSE:GME) is doomed. The company certainly has a lot going against it, as digital downloads are becoming more popular and the threat of the game console makers disallowing used games puts GameStop Corp. (NYSE:GME)’s business in jeopardy. But is the company in danger of going bankrupt anytime soon? Here is the z-score calculation.

All values in millions

Gamestop’s z-score has been surprisingly steady over the past five years, staying in the high 3’s most of the time. This value is well within the “safe zone” and leads to the conclusion that GameStop Corp. (NYSE:GME) is in no danger of going bankrupt in the next few years. This says nothing about its prospects ten years out, as there are definitely real threats to its business model, but today the company is in good shape financially.

EBIT turned negative in 2012, but this is largely due to a large $681 million asset impairment. Excluding this item net income only fell slightly from the prior year’s adjusted value, so the company is actually in even better shape than the numbers above suggest. Another positive is a new game console generation arriving this fall, with Sony and Microsoft set to release new consoles. This should provide a boost to Gamestop’s top line as interest in video games grows.

It’s hard to say what GameStop Corp. (NYSE:GME)’s long-term prospects are, but the company is financially sound and is in no danger of bankruptcy.

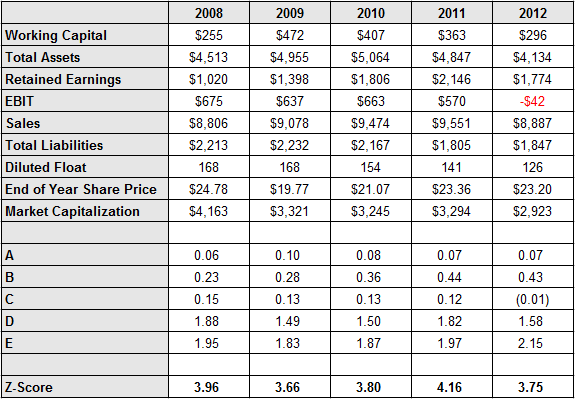

BlackBerry

BlackBerry, once called Research in Motion, used to be the dominant provider of smart phones. From 2003 to 2010 revenue grew at an annualized rate of 65%, topping out at $19.9 billion. Net income in that year was $3.4 billion. But Research In Motion Ltd (NASDAQ:BBRY) couldn’t keep up with the likes of the iPhone and Android, and sales plummeted back to just $11 billion in 2012 as net income turned resoundingly negative. How likely is Research In Motion Ltd (NASDAQ:BBRY) to go bankrupt in the next few years? Here’s the z-score calculation.

All values in millions

In its heyday BlackBerry’s z-score was high enough to be irrelevant. But by 2012 the z-score had fallen to 2.74, which is in the “grey zone.” What does this mean? Well, Research In Motion Ltd (NASDAQ:BBRY) isn’t in any immediate threat of bankruptcy, but the situation is getting worse. The company has no debt, so it would take a few years of big losses before it would have to turn to debt to finance operations.

Earlier this year Research In Motion Ltd (NASDAQ:BBRY) launched its much awaited Z10 phone, which has the company’s brand new BlackBerry 10 operating system. These new phones are competing against Apple’s iPhone, a slew of Android phones, and Windows phones, and it will be tough for the company to gain any traction. It seems unlikely that Research In Motion Ltd (NASDAQ:BBRY) can return to dominance, and questionable whether or not the company can become profitable again. The new phones launched recently, so time will tell if they prove to be popular. If they fail, then BlackBerry will likely see its z-score slide into the danger zone and bankruptcy will become a real possibility.

Nokia

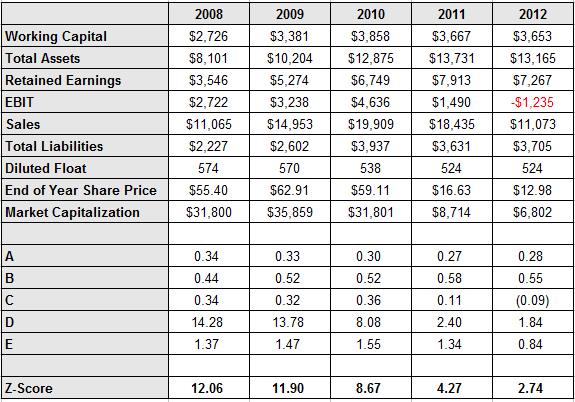

Nokia Corporation (ADR) (NYSE:NOK) is a Finnish company that is now best known for partnering with Microsoft and selling the Nokia Lumia line of Windows Phones. The company still sells a large number of non-smart phones around the world, but this number has and will continue to shrink as the smart phone market grows. In Q1 of 2013 Nokia Corporation (ADR) (NYSE:NOK) sold 5.6 million Lumias, although most of these were outside of North America. This is up from 4.4 million in the previous quarter. However, the company still was unprofitable during the quarter, as it has been for the past two years. Is the company in danger of going bankrupt? Here’s the z-score calculation.

All values in millions

I’ve converted the share price to Euros for the purpose of the calculation. Since everything is a ratio the currency doesn’t matter as long as every value is in the same currency.

By 2012 Nokia’s z-score had fallen within the danger zone, and if the losses incurred that year continue the company will be in big trouble. However, the first quarter of this year was far better than the last in terms of profitability. Revenue dropped, but net income went from -929 million EUR to -272 million EUR, and EBIT went from -1,340 million EUR to -150 million EUR. If Lumia sales continue to rise it’s possible that Nokia Corporation (ADR) (NYSE:NOK) could return to profitability this year or the next.

Of course, Windows Phone could fail to gain any considerable market share, in which case Nokia Corporation (ADR) (NYSE:NOK) would likely be finished. But it seems that Windows Phone is gaining some traction, as market share in the US has grown from 3.7% in the first quarter of 2012 to 5.6% in the first quarter of 2013. And since Nokia Corporation (ADR) (NYSE:NOK) accounts for most of Windows Phone sales by choosing to partner with Microsoft the company has differentiated its products from a slew of Android-based devices.

Nokia’s future depends on Windows Phone gaining market share, and with Microsoft’s support it seems that there is a good chance of this happening.

Data from Morningstar

The article Are These Companies in Danger of Going Bankrupt? originally appeared on Fool.com and is written by Timothy Green.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.