Oasis Management is a Hong Kong-based hedge fund founded in 2002. Its public equity portfolio was valued at $244.55 million on September 30, and the fund’s noteworthy picks returned 8.67% in Q3 based on its 8 long positions in companies with a market cap of at least $1 billion. Among the fund’s favorite stocks were Jones Lang LaSalle Inc (NYSE:JLL), Zayo Group Holdings Inc (NYSE:ZAYO), JAKKS Pacific, Inc. (NASDAQ:JAKK), and Forestar Group Inc. (NYSE:FOR).

The negative sentiment regarding hedge funds amid losses and declining returns could lead the average reader to think that hedge funds are bad stock pickers, which is not actually the case. When we look at the third-quarter returns of the hedge funds in our database which had at least 5 long positions in companies valued at $1 billion or more, we see their long picks returned 8.3% on average, a full 5.0 percentage points clear of S&P 500 ETFs. However, that long stock-picking prowess is often overshadowed by the hedged portion of their portfolios, in options, bonds, and short positions. We believe that investors should pay attention to hedge funds’ top picks for a chance to beat the market, and will share four such picks today, courtesy of the 13F portfolio of Oasis Management.

Oasis Management slashed its holding in Jones Lang LaSalle Inc (NYSE:JLL) by 32% in the third quarter, ending the period with a total of 187,049 shares of the company which had a total value of over $21.29 million. The stock returned 16.8% during the third quarter. Jones Lang LaSalle Inc (NYSE:JLL) was in 27 hedge funds’ portfolios at the end of the second quarter of 2016, down by 1 quarter-over-quarter. Among these funds, Generation Investment Management held the most valuable stake in Jones Lang LaSalle Inc (NYSE:JLL), which was worth $215.6 million at the end of the second quarter. Kerrisdale Capital and Millennium Management were also bullish on Jones Lang LaSalle Inc (NYSE:JLL).

Follow Jones Lang Lasalle Inc (NYSE:JLL)

Follow Jones Lang Lasalle Inc (NYSE:JLL)

Receive real-time insider trading and news alerts

Oasis Management boosted its stake in Zayo Group Holdings Inc (NYSE:ZAYO) by 143% in the third quarter, amassing over 1.73 million shares of the company. The total value of the stake rose to over $51.32 million by the end of the period. The fund had bought a new stake in the company in the second quarter, and the investment has been a success thus far, as the stock returned 6.4% during the third quarter. When looking at the institutional investors followed by Insider Monkey, John H. Scully’s SPO Advisory Corp has the biggest position in Zayo Group Holdings Inc (NYSE:ZAYO), worth close to $215 million. The second most bullish fund manager is Cadian Capital, led by Eric Bannasch, holding a $156.6 million position. Some other hedge funds and institutional investors that are bullish comprise Israel Englander’s Millennium Management, Bain Capital’s Brookside Capital, and Christopher Lord’s Criterion Capital.

Follow Zayo Group Holdings Inc. (NYSE:ZAYO)

Follow Zayo Group Holdings Inc. (NYSE:ZAYO)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

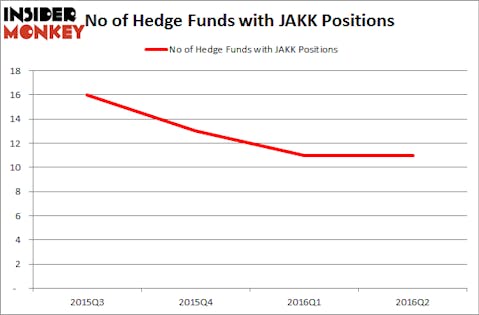

Oasis Management ended the third quarter with 1.2 million JAKKS Pacific, Inc. (NASDAQ:JAKK) shares in its portfolio, which had a total value of over $10.29 million. The stock returned 9.2% during the third quarter. At Q2’s end, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from the previous quarter. Among these funds, Renaissance Technologies held the most valuable stake in JAKKS Pacific, Inc. (NASDAQ:JAKK), which was worth $12.3 million at the end of the second quarter. Archer Capital Management, D E Shaw, and AQR Capital Management were also bullish on JAKKS Pacific, Inc. (NASDAQ:JAKK).

Follow Jakks Pacific Inc (NASDAQ:JAKK)

Follow Jakks Pacific Inc (NASDAQ:JAKK)

Receive real-time insider trading and news alerts

Lastly, Oasis Management increased its stake in Forestar Group Inc. (NYSE:FOR) by 4% in the third quarter, having reported ownership of 787,382 shares of the company as of September 30, valued at $9.22 million. Oasis upped its stake in the company by 41% in the second quarter. Forestar’s stock, however, recorded a disappointing drop of 1.5% in the third quarter. Heading into that quarter, a total of 10 of the hedge funds in our database held long positions in Forestar, down by 23% from the first quarter of 2016. Carlson Capital was the largest shareholder of Forestar Group Inc. (NYSE:FOR) among the 10 funds, with a stake worth $31.6 million. Trailing Carlson Capital was Gratia Capital, which amassed a stake valued at $9.4 million.

Follow Forestar Group Inc. (NYSE:FOR)

Follow Forestar Group Inc. (NYSE:FOR)

Receive real-time insider trading and news alerts

Disclosure: None