It seems like Family Dollar Stores, Inc. (NYSE:FDO) and Dollar General Corp. (NYSE:DG) are in a race to put a store on every street corner in America. This strategy of mindless expansion opens the door to vast numbers of potential customers, but it also shows some of the signs of a bubble.

Dollar General alone is planning to add 600 stores this year, which will give it 11,000 locations. That’ll make the dollar store operator the retailer with the most locations in America. Family Dollar currently operates 7,600 stores in 45 states and employs 50,000 people.

The Numbers Just Don’t Add Up

Can this kind of growth be sustained even in a nation that might be in economic recovery? The numbers say no; a SWOT analysis indicates that the U.S. discount market could support 15,000 additional dollar stores. The problem is when you add the number of stores Family Dollar Stores, Inc. (NYSE:FDO) operates and the number Dollar General Corp. (NYSE:DG) plans to open by the end of this year, the result is 18,600 dollar stores. Those numbers alone already exceed the number of new dollar stores the market might support.

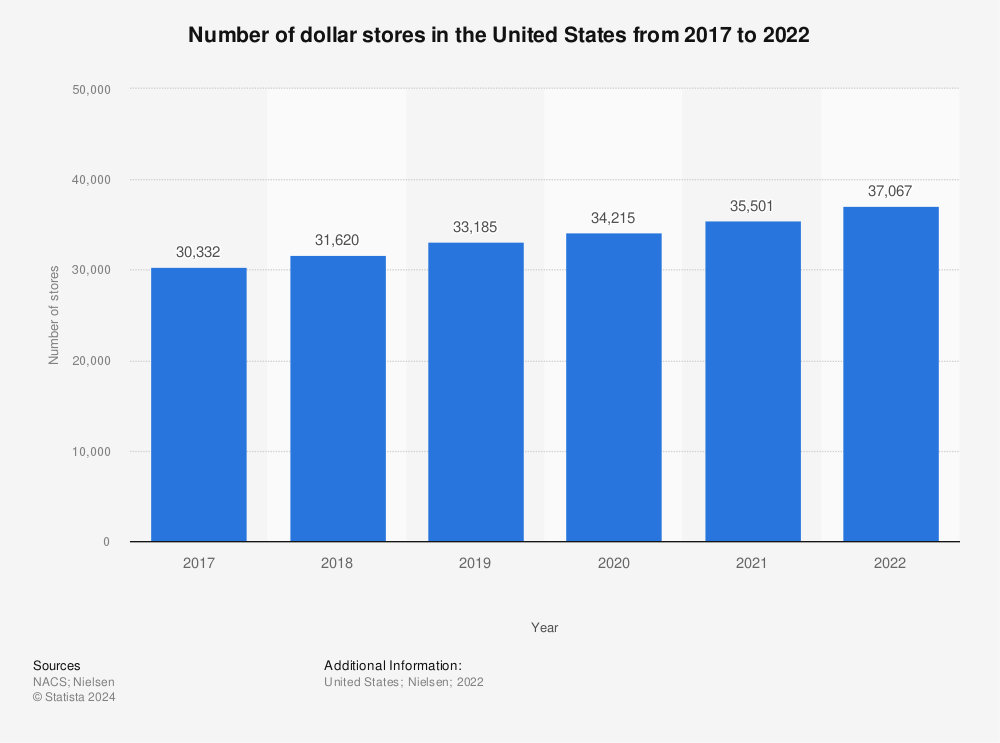

You will find more statistics at Statista

There are currently 24,512 dollar stores in the U.S. and Statista.com claims that there are plans to open another 6,281 by 2016. The number of dime stores currently operated by the three biggest operators—Dollar General Corp. (NYSE:DG), Family Dollar Stores, Inc. (NYSE:FDO)and Dollar Tree (NASDAQ:DLTR) —is 19,500. If this rate of growth continues, we’ll hit that 15,000 number real soon; possibly as soon as 2017. It looks like the dollar store industry may soon reach the limits of growth.

Negative Cash Flow at Dollar General and Family Dollar

The cash flow numbers at both Family Dollar and Dollar General Corp. (NYSE:DG) call the expansion strategy into question. The latest figures indicate that both companies reported a negative cash flow.

Family Dollar Stores, Inc. (NYSE:FDO) reported a free cash flow of -$50.21 million on Feb. 28, 2013, while Dollar General did a little better posting a free cash flow of -$2.43 million. Neither company can generate extra cash with the locations they have now, yet they keep expanding mindlessly.

With such dismal cash flow, it’s also obvious how the dollar store operators are financing expansion: by borrowing a lot of money. How are they supposed to pay off those debts if they cannot generate a positive cash flow with their current locations?

Revenue Figures Might Justify Expansion

It’s not just expansion that dollar store operators are spending money on. Family Dollar Stores, Inc. (NYSE:FDO)’s capital expenditures rose from $130.9 million in first quarter 2012 to $196.4 million in first quarter 2013.

The dollar store operator is burning through a lot of cash in its effort to be the big dog. Analyst Victor Selva estimates that Family Dollar’s capital expenditures for 2013 could be $650 million.

The only thing that can justify these expenditures is continued growth in revenue. Family Dollar Stores, Inc. (NYSE:FDO)’s revenues went from $6.98 billion in August 2008 to $10.4 billion on Feb. 28, 2013. Dollar General Corp. (NYSE:DG)’s revenue growth was even more impressive; its revenues went from $9.89 billion in July 2008 to $15.35 billion on April 30, 2013.

Will the Party End?

The expenditures could be sustainable if the revenues keep going up, but what if they don’t? Family Dollar reported sluggish sales at its last conference call and cut its earnings forecast.

This drop in sales can be attributed to cuts in food stamps and unemployment insurance programs. Selva estimated that between 10% and 15% of Family Dollar’s customers are on these programs.

Betting on Growth

Family Dollar Stores, Inc. (NYSE:FDO) and Dollar General Corp. (NYSE:DG) have both made an expensive bet on continued expansion. Like a lot of other retailers, they seem to think that revenues will magically expand as new locations open.

So far this bet has paid off, but it doesn’t look sustainable. The dollar store operators need to take a look at the numbers and rethink their expansion plans. If they don’t, there may be no

The article Are Dollar Stores a Bubble? originally appeared on Fool.com and is written by Daniel Jennings.

Daniel Jennings has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Daniel is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.